Bitcoin price crashed to a low of $91,170 on Monday, as cryptocurrencies and the stock market crashed.

Bitcoin (BTC) moved into a technical correction, falling by over 16% from its highest level this year.

Its drop was mainly due to potential stagflation risks in the United States and its impact on the Federal Reserve.

Donald Trump has unveiled wide-ranging tariffs on American, Canadian, and Chinese goods. These tariffs will likely lead to higher inflation as companies are forced to hike prices. As such, the headline and core inflation will likely remain above the 2% target for longer.

The tariffs may also impact consumer spending, which is the biggest part of the economy. Many consumers may wait to make big purchases until they have more clarity on the tariffs and the outcome of potential negotiations.

The Federal Reserve may maintain higher interest rates for longer, affecting risky assets like Bitcoin and stocks.

Bitcoin’s crash led to a sharp increase in liquidations as exchanges closed leveraged bullish positions as it dropped. According to CoinGlass, the daily liquidations jumped to almost $400 million, the highest level in weeks.

There are three main reasons why Bitcoin price may rebound after Monday’s crash. First, it tends to end the week positively in recent weeks when it falls on a Monday.

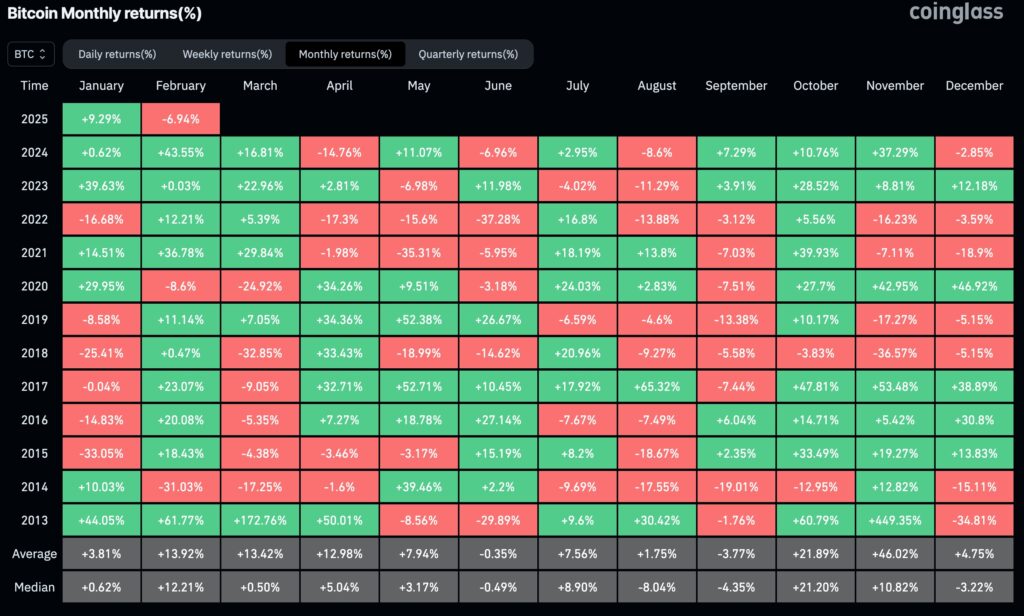

Second, seasonality data shows that Bitcoin usually rises in February. It has risen in February of the last four consecutive years. The average returns in February since 2013 is about 14%, making it the second-best month after November.

Third, Donald Trump is likely to use the threat of tariffs to negotiate a better deal than he did in his first term. As such, crypto and stocks may rebound when trade talks start, possibly this month.

Bitcoin price forecast

The daily chart shows that Bitcoin price has moved sideways in the past few months. It dropped to a low of $91,170, a key point where it has failed to drop below since November. This consolidation has led to the formation of a bullish flag pattern, comprising of a long vertical line and a rectangle pattern.

Bitcoin price has also remained above the 50-day and 100-day Exponential Moving Averages. Therefore, it will likely have a strong bullish breakout later this month, with the initial target being the year-to-date high of $109,200.