Steven Pu, co-founder of layer-1 blockchain Taraxa, released a report on Feb. 24 highlighting a significant gap between claimed and actual blockchain performance.

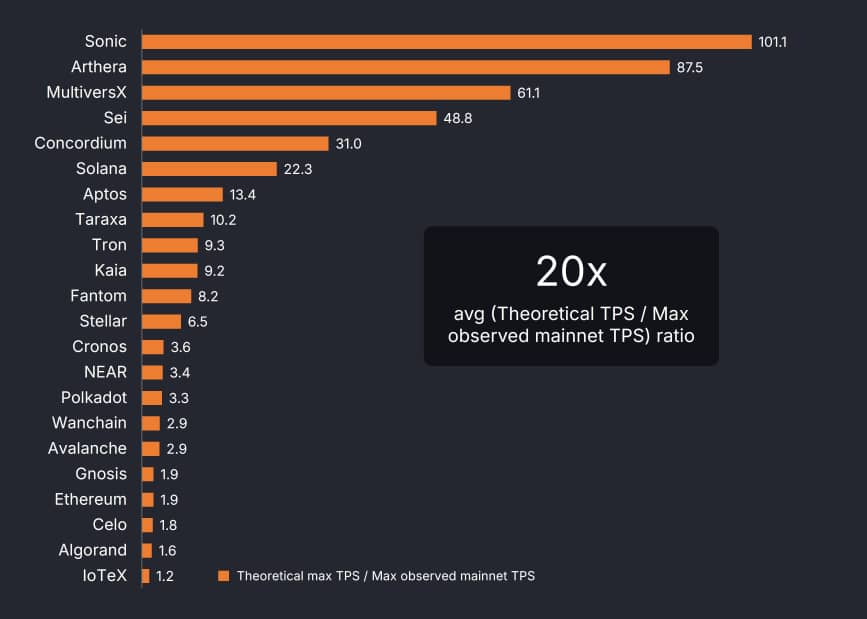

Analyzing 22 networks using data from Chainspect, the study found that theoretical transactions per second (TPS) are overstated by an average of 20 times compared to real-world results. According to the findings, this discrepancy stems from lab-based metrics that fail to hold up on live mainnets.

The report introduces a new metric: TPS per dollar spent on a validator node (TPS/$), aiming to measure cost-efficiency rather than just raw speed. Across the 22 chains, theoretical TPS averaged 20 times higher than observed mainnet performance, with only four networks achieving double-digit TPS/$ ratios.

Pu argues this shows many blockchains require costly hardware for modest transaction rates, challenging claims of scalability and decentralization.

“We should all stick with transparent, verifiable, on-chain performance metrics,” per the study.

Blockchain scalability questioned

Pu’s findings suggest the industry’s focus on high TPS misleads stakeholders. Bitcoin (BTC) and Ethereum (ETH), for example, prioritize security over speed, while newer chains tout big numbers that rarely materialize. The TPS/$ metric could shift how developers assess networks for practical use cases like payments or supply chain tracking. The report states that,

Max observed mainnet TPS for included networks, across a 100-block window (tx/s)

It’s worth noting that Chainspect specifically excludes transactions that may unfairly inflate this Max TPS metric, such as voting transactions

Taraxa pushes for transparency

Taraxa, a proof-of-stake layer-1 focused on audit logging, frames this as a wake-up call. Pu, a Stanford-educated entrepreneur, urges reliance on verifiable mainnet data over whitepaper hype.

This comes as the crypto space grapples with adoption hurdles. Inflated statistics could distort investment and development decisions, particularly in decentralized finance and supply chain use cases that demand reliable performance. Pu suggests that cost-efficiency metrics like TPS/$ could redefine how blockchain sustainability is evaluated, shifting focus toward networks that deliver practical value rather than just high theoretical speeds.