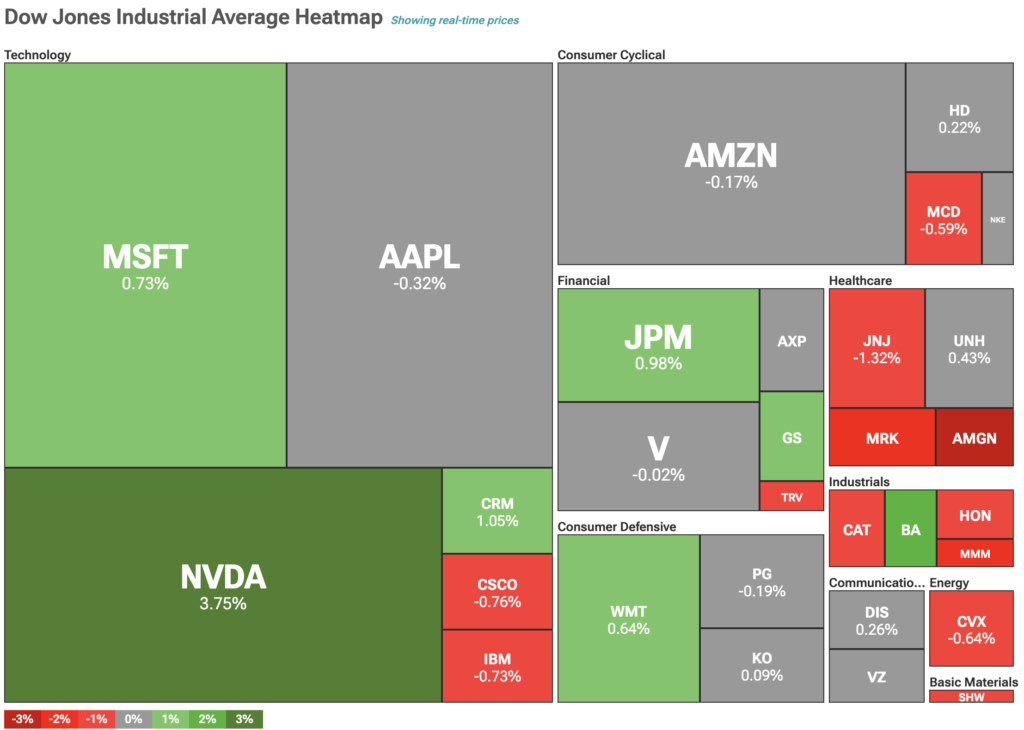

U.S. shares have been barely blended on Wednesday, as chipmakers noticed main positive aspects on new deals with Saudi Arabia.

Shares have been blended on Wednesday, with the Dow Jones buying and selling decrease by round 0.25% whereas the S&P 500 remained flat. The tech-heavy Nasdaq rose 0.75%, or 142.58 factors, to 19,150.

This efficiency adopted a robust exhibiting earlier within the week, as traders reacted to the pausing of reciprocal tariffs between the U.S. and China. Including to the optimistic sentiment, lately launched April inflation figures have been at their lowest ranges since 2021.

Chipmakers lead Nasdaq rally

Easing commerce relations and decrease inflation information contributed to bullish sentiment within the markets. Among the many finest performers have been tech shares, particularly chipmakers, which benefited from a lately negotiated deal between U.S. companies and Saudi Arabia.

Particularly, throughout an funding discussion board on Tuesday attended by U.S. President Donald Trump, Saudi Arabia introduced billions in deals with chipmakers. Following the information, the world’s largest chipmaker, Nvidia, rose 3.75%, buying and selling at $134.85 per share.

Regardless of the optimistic sentiment in equities, the greenback index edged decrease on Wednesday, down 0.21% to 100.80 factors. On the similar time, gold posted important losses of 1.91%, buying and selling at $3,182.22. A divestment from the greenback and gold signifies that traders are chasing larger returns within the inventory markets.

Bitcoin (BTC) as soon as once more moved in the identical course as gold, down 0.66% to $103,378. Nonetheless, the digital gold thesis for Bitcoin will not be the one clarification, as crypto costs started rallying days forward of the inventory markets when Bitcoin first broke $100,000. As a substitute, crypto costs are possible consolidating and cooling off—suggesting that the identical might observe for shares within the close to future.