Maple Finance’s token continued its sturdy rally, reaching its highest degree since November final 12 months as its belongings and price income surged.

Maple (SYRUP) jumped to a excessive of $0.3490, up 287% from its lowest degree this 12 months, bringing its market cap to $374 million. The rally got here in a high-volume atmosphere, with 24-hour buying and selling quantity rising to $150 million.

SYRUP token jumped as the entire worth locked in its community jumped to a report excessive of $1.17 billion, up from this 12 months’s low of $250 million. This efficiency makes it one of many best-performing gamers in decentralized finance.

The expansion has translated into increased community income. In accordance with TokenTerminal, the protocol generated over $600,000 in income in April, practically double the earlier month’s determine.

https://twitter.com/tokenterminal/standing/1923023511544647971

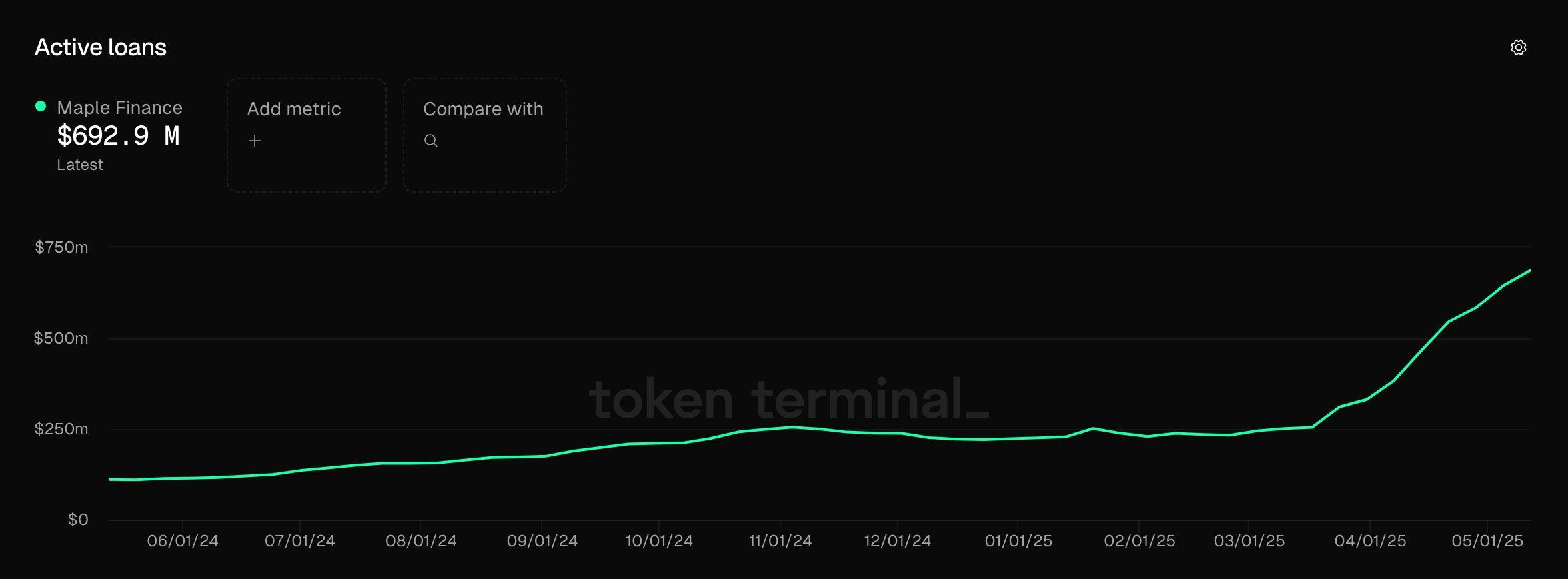

Moreover, the quantity of lively loans on Maple has climbed to a report $692 million, a pointy enhance from $250 million firstly of the 12 months.

SYRUP’s worth additionally benefited from new trade listings over the previous few months. It grew to become out there on dYdX, one of many main decentralized exchanges, on Thursday. Earlier this month, it was additionally listed on Binance and Bitget earlier this month.

Maple Finance is constructing a decentralized platform the place verified lenders present capital to establishments. Its Blue-Chip Secured Lending Pool lends USDC, overcollateralized by Bitcoin (BTC) and Ethereum (ETH). The Excessive Yield Secured provides the identical service, however is overcollateralized by BTC, ETH, and liquid altcoins.

Maple additionally launched the BTC Yield product that permits Bitcoin holders to earn a return on their belongings.

SYRUP worth evaluation

The eight-hour chart reveals that SYRUP has been in a robust uptrend, positioning Maple as a rising pressure in DeFi. The token lately broke above a key resistance degree at $0.1930—its March excessive—flipping it into assist.

Maple Finance token stays above the 50-period exponential shifting common, an indication that bulls are in management. Nonetheless, there are indicators that it has develop into overbought because the Relative Power Index has moved to 75.

As such, the most certainly near-term state of affairs is a pullback towards the $0.20 assist degree, adopted by a possible continuation of the broader bullish pattern.