Since decentralized crypto exchanges (DEX) take the privacy of users to a different level. Hence they are rising even though the mass is still on centralized crypto exchanges such as Binance. IDEX, a decentralized crypto exchange, offers a secure and rich trading experience to traders. Further, to know whether IDEX is an efficient platform or not, read this Idex Review that will surely give you the necessary insights into the platform.

Summary

- Idex exchange is an Ethereum based cryptocurrency exchange platform.

- The platform is equipped with a high-performance trading engine and offers a rich trading experience.

- IDEX comes with a polished UI which makes it better than the centralized exchanges.

- The non-custodial feature gives the users complete control over the assets and also takes care of the security.

- There are various order types for you to choose.

- The platform charges 0.2% for the market taker and 0.1% for the market maker.

- You can also stake IDEX tokens and get up to 50% of the trade fees that you pay.

- Customer support is very effective and helps you if you get stuck anywhere while using the platform.

What is IDEX?

IDEX is a crypto exchange platform that offers a user-friendly interface without compromising on security. It is a dex exchange based on Ethereum, which is considered to be the most advanced platform.

Moreover, the platform has built a smart contract that enables the storage of all assets and execution of trade settlements.

The platform is available in different, languages namely, English, Russian, South Korean, Vietnamese, Spanish, and Mandarin.

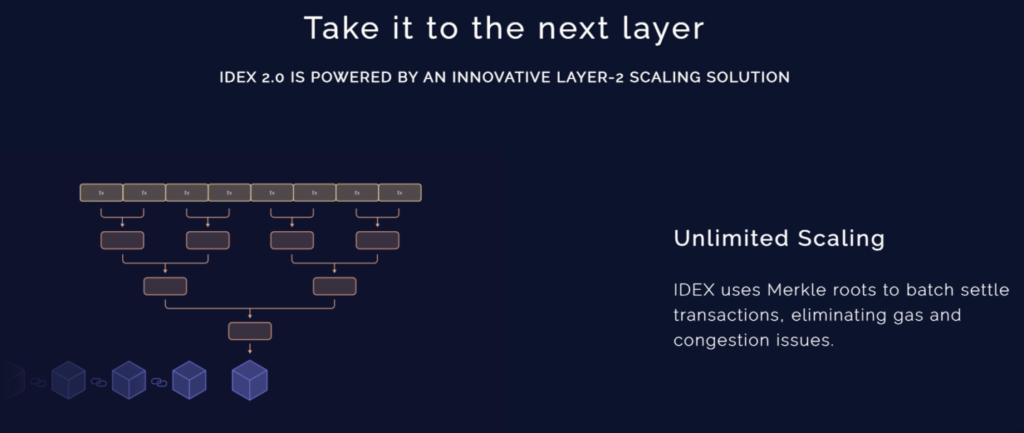

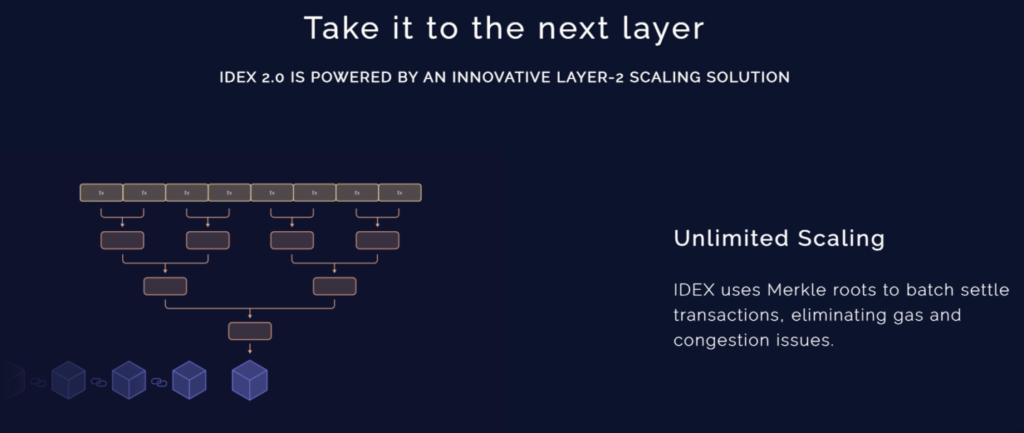

Additionally, the platform is also working on building layer 2 to provide you with maximum security.

IDEX Review: Trading View

The most common things that a trading view shows are:

- The order book or its position

- The price chart of the selected cryptocurrency

- The order history

Before investing, always go through the trading views of the exchange platforms. The below picture shows the trading view of the IDEX exchange platform.

IDEX Review: Order Types

- Market: IDEX market order is an order to buy and sell a quantity immediately at the current price. It is the simplest of all order types.

- Limit: It is an order to buy a security price or sell a security at a price no lesser than the specific price.

- LimitMaker: It is a limited order that can only add liquidity to the order book.

- StopLoss Limit: It is an order that is placed to limit the loss.

- StopLoss: It is an order placed to buy/sell a security once it reaches a specific price.

- Take Profit: It is an order that specifies the exact price at which to close out an open position for a profit.

IDEX Review: IDEX Token and Staking

The IDEX token is the platform’s primary token. It enables the users to contribute to the project. Further, the IDEX token also benefits the users as you can stake them and earn rewards.

Furthermore, you are rewarded with about 50% of the trade fees paid. The staking occurs after every 14 days. The IDEX staking replicator software enables you to stake IDEX tokens.

Suppose you wish to participate in the IDEX replicator staking program. In that case, you must have a balance of a minimum of 10,000 IDEX in your wallet.

If you wish to stake the assets you’re HODLing and earn a passive income, read our ultimate guide to crypto staking.

IDEX 2.0 Review

IDEX 2.0 improves the trading experience of cryptocurrency users. Therefore, IDEX 2.0 inherits the speed and features of centralized exchanges along with the security of DEX. The different components of IDEX 2.0 are:

- A high-performance trading engine is capable of processing thousands of orders every second. It guarantees trade execution with zero hassle.

- Polished UI provides a brand new interface and some advanced trading options and features that you would find on centralized exchanges.

- The upgraded API supports all the order types that you expect.

- IDEX-2.0 uses an Innovative layer-2 design.

IDEX Review: Deposit Methods

To deposit, you need to unlock a BSC or ETH wallet on IDEX. Then, you need to deposit funds into that wallet. After that, you need to deposit what you want to trade with into the IDEX on the balance page. You can deposit funds only through cryptocurrency transfer. Moreover, Fiat Currency deposits are not acceptable.

IDEX Exchange Review: Minimum Limits

The below table shows the trade and withdrawal minimum limits on the IDEX exchange platform.

| Type | ETH Minimum | BSC Minimum |

|---|---|---|

| Maker Trade | 1.0 ETH | 0.25 BNB |

| Taker Trade | 0.5 ETH | 0.05 BNB |

| Withdrawal | 0.4 ETH | 0.01 BNB |

IDEX Review: Fee Structure

IDEX exchange platform collects three different types of fees: Maker Trade fees, Taker Trade fees, and Withdrawal Fees. IDEX fees is mentioned below:

- Maker Trade Fees: The default Maker Trade fee is 0.1%. Thus, the Maker receives (1 – 0,001) * quantity of ETH, with 0.001 * amount of ETH collected as the maker fee.

- Taker Trade Fees: The default Taker fee is 0.2%. Therefore, the taker receives ( 1 – 0.002) * quantity of USDC with 0.002 * quantity of USDC collected as the taker fee.

- Withdrawal Fees: IDEX collects withdrawal fees to cover the cost of gas for the resulting BNB, ETH, or Token transfer. The withdrawals are initiated through the REST API.

Passive income sounds cool, right? Read our Ledger Live Review – Best Way to Earn Passive Income directly from your hardware wallet.

Is IDEX Safe?

Yes, IDEX is safe to use. Being a dex, IDEX offers better security features than a centralized exchange platform as you own the keys. Furthermore, it provides the security benefits that the blockchain provides. The platform does not control the funds of its users. Moreover, it keeps the funds in a smart contract on the Etherum blockchain.

Somehow, if the hacker is able to exploit the IDEX crypto platform, he will not access the user’s assets. However, there are many issues being faces by DEXs, such as lower liquidity, slow speed, no-cross chain communication, etc.

IDEX Review: Fund Custody

Being a high-performance and non-custodial exchange platform, IDEX does not take custody of the user’s funds. Instead, it relies on smart contracts to hold the funds, track user balance, and settle trades.

Besides, the funds are to be deposited before trading but can be withdrawn even if the platform ceases to operate. The funds cannot change hands without authorization from the user’s wallet.

Moreover, the user’s funds are secured by a smart contract with compelling security features.

Do you know what can be more secure than DEX? A hardware wallet! To learn more, read our guide to the best crypto hardware wallets.

Customer Support

IDEX customer support helps its users in every possible way. It also extends its services to its official Telegram and Discord. Unfortunately, if you are stuck somewhere, you can seek help through supportive help, where you can ask questions and get all the solutions through the chat option.

Further, this live chat will give you instant replies. You can also take help from the FAQ section available on the IDEX website for instant solutions and answers. In case of any queries, you can contact [email protected].

IDEX Review: Pros and Cons

| Pros | Cons |

|---|---|

| The IDEX exchange platform offers a wide variety of security features. | Fiat currency trading is not supported. |

| Provides access to several crypto tokens. | Not suitable for beginners, and the order minimums are high. |

| It is integrated with MetaMask and Nano S. | Currently no mobile app for the platform. |

| IDEX 2.0 claims to solve the liquidity problem. | The platform suffers from low liquidity. |

IDEX Exchange Review: Conclusion

To conclude, IDEX is a decentralized exchange but inherits all the features of centralized exchanges. Additionally, the platform offers a user-friendly interface and optimized trading experience to the users. Finally, one of the best features is that it provides efficient customer support. Therefore, the IDEX exchange platform is a suitable option for traders planning to purchase ERC 20 tokens.

When it comes to security, the platform has proven to be a secure one as it does not take over the custody of the user’s assets. Moreover, the smart contract, the high-performance trading engine, enables the traders to have a positive experience on the platform.

Frequently Asked Questions

How to withdraw from IDEX?

You need to click on “Balances” present on top of the navigation bar. Then, click on “withdraw” after locating the assets. Then, enter the amount, and if you want to withdraw all amounts, click on “Maximum.” To see the withdrawal status, visit the balance history page.

Where can I purchase IDEX Token?

You can purchase IDEX Token on the IDEX exchange platform. Also, the IDEX token is available on Binance. The entire list of exchanges that trade IDEX is listed on the CoinMarketCap.

What are gas fees?

The transactions on the Ethereum network costs the users gas fees. It is the fee that is paid to the miners to proceed with the transaction. The IDEX 2.0 will enable a gas-free trading experience for the users.