Aerodrome Finance’s token continued its strong bullish momentum on Thursday, June 19, as network activity and market share surged.

Aerodrome Finance (AERO) price rose to a high of $0.9660, its highest swing since February 4, and 235% above its lowest point in April. This surge has brought its fully diluted valuation to over $1.54 billion.

AERO’s breakout coincided with rising market share in the decentralized exchange sector. DeFi Llama data shows that Aerodrome is now the sixth-largest DEX by monthly volume, trailing only PancakeSwap, Uniswap, Raydium, Orca, and Pump. The protocol processed over $14.86 billion in trading volume over the past 30 days.

On Base, the layer-2 network developed by Coinbase, Aerodrome continues to dominate. It handled over $525 million in transactions, outperforming Uniswap’s $349 million on the same chain. This spike in activity has translated into higher protocol revenue, with monthly fees rising to $19.7 million in May, up from $13.2 million a month earlier. It has made over $10 million so far this month.

Aerodrome’s growth trajectory may continue, especially following Coinbase’s announcement that it will support top DEX networks on Base within its platform. This integration could introduce Aerodrome to millions of new users across Coinbase’s mobile and web applications.

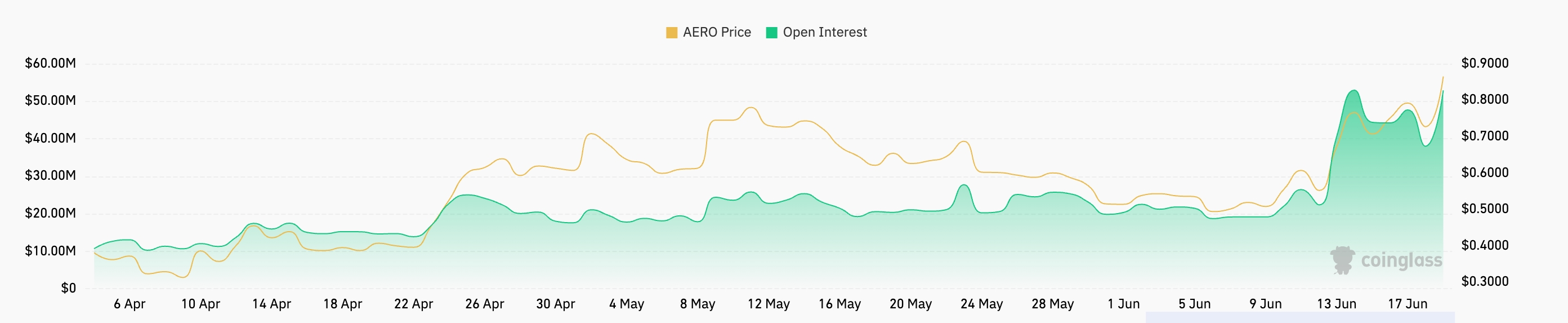

The AERO token also surged alongside a sharp rise in futures open interest, which climbed to a record $52.9 million, up from a monthly low of $19 million. Rising open interest typically signals growing demand and deeper liquidity.

AERO price technical analysis

The AERO token price surged to the highest point since February as crypto.news predicted here. The price moved decisively above the $0.8010 resistance level—coinciding with the 23.6% Fibonacci retracement, and also cleared the upper boundary of an ascending triangle pattern, a widely recognized continuation signal.

AERO price has moved above the 50-day Exponential Moving Average, while the Relative Strength Index has pointed upwards and is nearing the overbought level.

Given these conditions, AERO is likely to maintain its uptrend, with bulls targeting the 50% Fibonacci retracement level at $1.3170, about 41% above current levels. A drop back below the triangle’s upper boundary would invalidate this bullish outlook.