Japanese company Metaplanet issued 54 million shares to expand its Bitcoin holdings further.

Companies are doubling down on their Bitcoin (BTC) treasury strategies. On Wednesday, June 25, Metaplanet, a Japanese budget hotel firm turned Bitcoin fund, issued 54 million new shares to expand its BTC holdings.

The new shares, issued with the help of institutional investor EVO FUND, are worth ¥74.9 billion, or about $515 million. The significant raise makes this the largest single-day equity-based Bitcoin treasury event to date.

The move is part of a strategy to make Metaplanet one of the largest corporate Bitcoin holders. Currently, Metaplanet holds 11,111 BTC, worth around $1.07 billion, already placing it among the top 10 corporate BTC holders in the world.

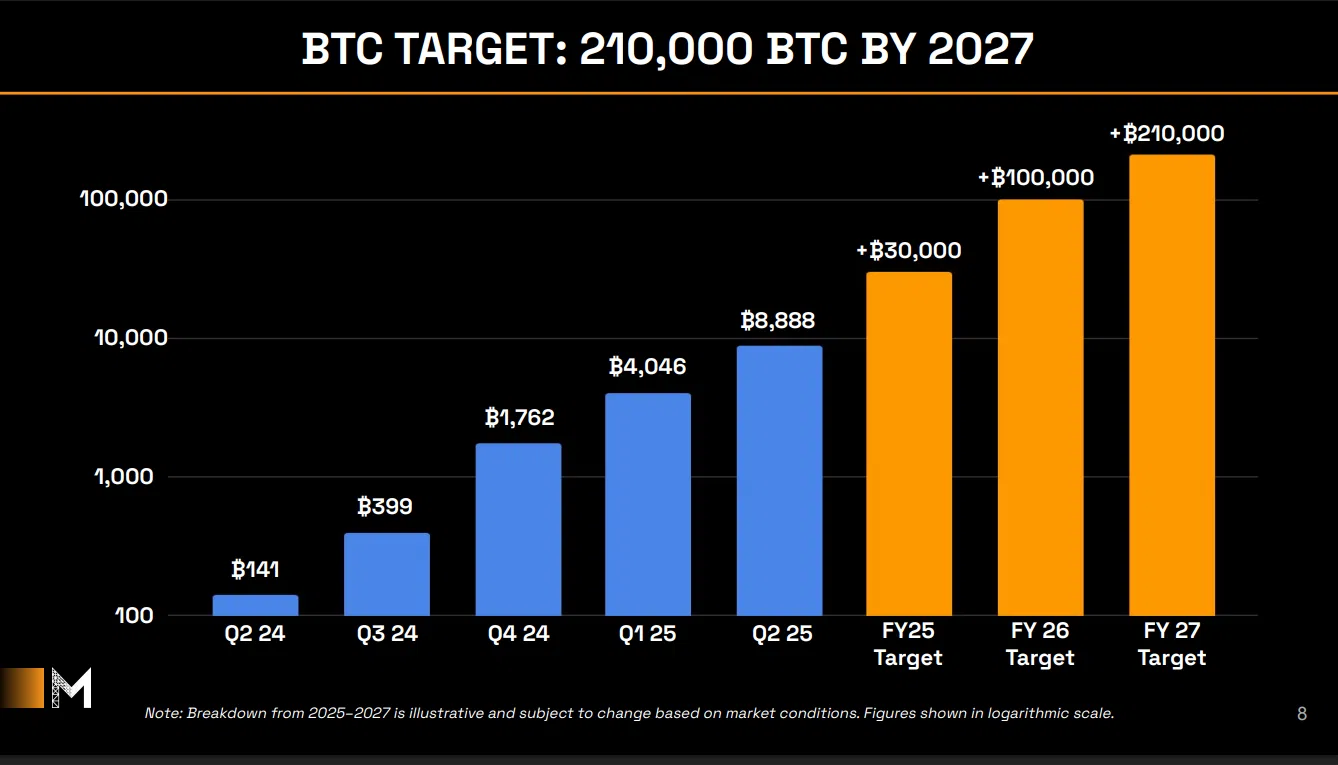

In line with this strategy, Metaplanet has released aggressive targets for BTC accumulation in the coming years. It plans to acquire 30,000 BTC by the end of 2025, 100,000 BTC by the end of 2026, and 210,000 BTC by the end of 2027.

Metaplanet BTC buys raise concerns over dilution

Metaplanet was one of the first firms in Asia to follow in the footsteps of Michael Saylor’s Strategy. Like Strategy, the company seeks to raise funds through stock offerings to buy Bitcoin. Both firms aim to benefit from Bitcoin’s appreciation and investor enthusiasm for the asset.

Still, Metaplanet is using a somewhat more conservative approach. Unlike Strategy, it does not buy Bitcoin with debt. This shields the firm from potential bankruptcy if the price of Bitcoin declines significantly, which remains a risk for MicroStrategy.

Metaplanet’s aggressive share issuance has raised concerns about stock dilution, with total shares set to climb to 760 million. This has prompted some hedge funds to bet against Metaplanet, building significant short positions against the company.