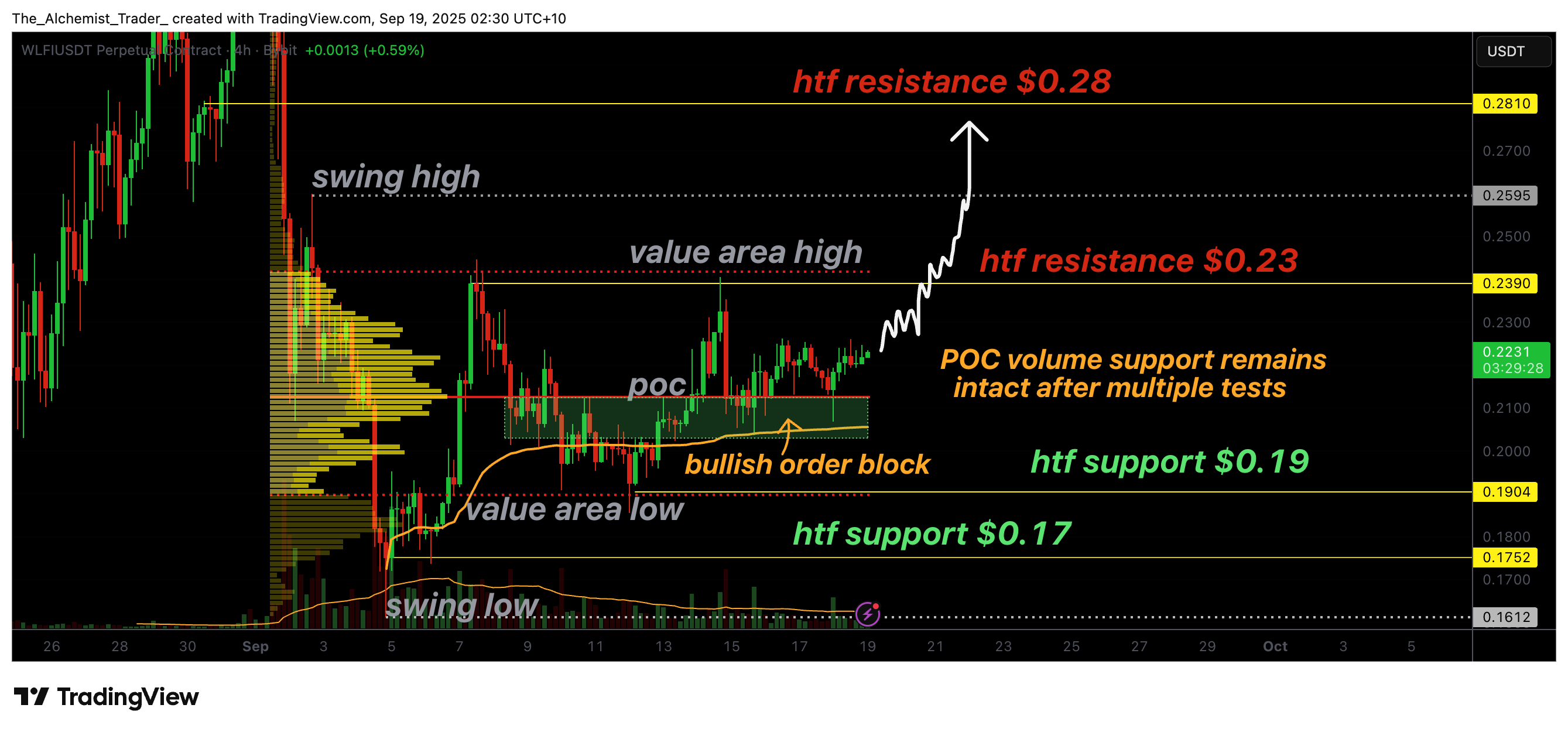

World Liberty Financial price continues to hold a strong bullish structure, finding consistent demand at high-volume trade regions. With $0.23 acting as a key resistance, a breakout could accelerate price toward $0.28.

Summary

- Support Zone: POC, VWAP, and bullish order block show clear demand.

- $0.23 Resistance: Key level to reclaim for continuation.

- Upside Target: Breakout could accelerate price toward $0.28.

World Liberty Financial (WLFI) price action has shown resilience by respecting a confluence of high-volume indicators. The point of control (POC), a bullish order block, and VWAP support all sit within the same region. Each time price has tested this zone, it has left a wick behind, confirming that buyers are stepping in to defend this area.

World Liberty Financial plans to use all protocol fees for buybacks and permanent token burns, adding a fundamental catalyst to the technical setup. The result is a market structure that continues to build higher lows, supporting the case for further upside.

World Liberty Financial price key technical points:

- Strong Support Zone: Confluence of POC, bullish order block, and VWAP support indicates clear demand.

- Resistance Levels: $0.23 high-time-frame resistance is the next critical hurdle.

- Bullish Target: Break above $0.23 opens the door to $0.28.

Price has repeatedly tested the high-volume trade location and each time concluded with strong demand signals. Wicks forming at these levels highlight the presence of buyers defending support, suggesting accumulation is underway. As long as the structure of consecutive higher lows remains intact, WLFI has a high probability of rotating upward toward the value area high at $0.23.

This resistance is significant, as it aligns with historical rejection zones. However, repeated tests weaken resistance, and WLFI is showing the early stages of building pressure beneath it. If bulls can achieve a clean breakout with conviction, the next upside target lies at $0.28, offering a strong continuation trade.

For the move to materialize, volume inflows will be the deciding factor. The presence of bullish nodes on the volume profile is essential for confirming that buyers are committed to pushing price through resistance. Without these inflows, WLFI risks further consolidation within the current range.

However, recent patterns suggest that demand is present, and the repeated defense of support adds weight to the bullish case. A decisive increase in volume as WLFI approaches $0.23 would likely trigger acceleration into higher levels.

What to expect in the coming price action

WLFI remains bullish across multiple perspectives, technical structure, market structure, and volume analysis. As long as higher lows continue to form, the probability of testing $0.23 resistance remains high.

A confirmed breakout above this level would pave the way for an accelerated move toward $0.28. Traders should watch for strong volume inflows at resistance, as this will be the clearest signal of continuation.