Bitcoin ETFs recorded $103.57 million in net outflows on January 23, marking the fifth consecutive trading day of redemptions.

Summary

- Bitcoin ETFs lost $103.57M on Jan 23, marking five straight days of outflows.

- The sell-off has pulled $1.72B from Bitcoin ETFs since Jan 16.

- Ethereum ETFs also slid, extending their outflow streak to four sessions.

BlackRock’s IBIT led withdrawals with $101.62 million in outflows, while Fidelity’s FBTC posted $1.95 million in redemptions.

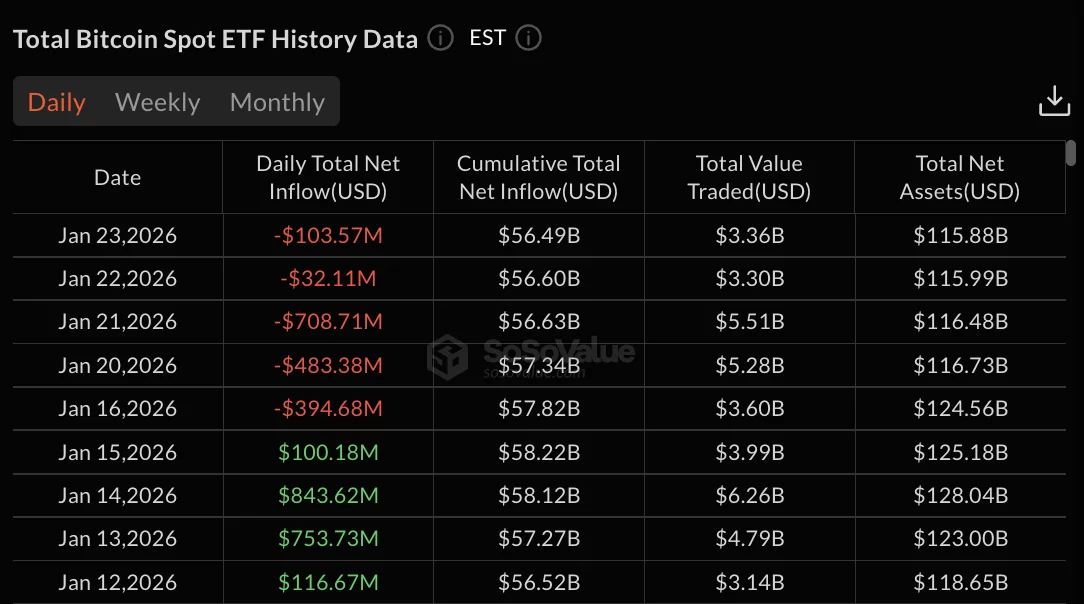

The five-day streak has drained approximately $1.72 billion from Bitcoin products. Total net assets under management fell to $115.88 billion from $124.56 billion on January 16.

At the same time, cumulative total net inflow dropped to $56.49 billion from $57.82 billion over the same period. Most Bitcoin ETFs recorded zero flows on January 23, with only IBIT and FBTC posting activity.

$708M Bitcoin ETFs exit

The bleeding began January 16 with $394.68 million in Bitcoin ETF outflows, reversing a four-day inflow streak that brought $1.81 billion into funds.

Markets were closed for the weekend before resuming redemptions January 20 with $483.38 million in withdrawals.

January 21 posted the largest single-day exodus at $708.71 million, followed by $32.11 million on January 22. The January 23 outflows of $103.57 million marked the fifth consecutive session of net redemptions.

Total value traded declined to $3.36 billion on January 23 from $5.51 billion on January 21. The sustained selling pressure has erased gains from mid-January when Bitcoin ETFs attracted strong institutional buying.

Grayscale’s GBTC and mini BTC trust, along with Bitwise’s BITB, Ark & 21Shares’ ARKB, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all recorded zero flows on January 23.

BlackRock’s IBIT holds $62.90 billion in cumulative net inflows. Fidelity’s FBTC has accumulated $11.46 billion in total inflows. Grayscale’s GBTC maintains -$25.58 billion in net outflows since converting from a trust structure.

Ethereum posts fourth consecutive outflow session

Ethereum spot ETFs recorded $41.74 million in net outflows on January 23, extending the redemption streak to four consecutive trading days.

BlackRock’s ETHA led withdrawals with $44.49 million, while Grayscale’s ETHE posted $10.80 million in outflows.

Grayscale’s mini ETH trust attracted $9.16 million in inflows, and Fidelity’s FETH saw $4.40 million in positive flows. Bitwise’s ETHW, VanEck’s ETHV, Franklin’s EZET, 21Shares’ TETH, and Invesco’s QETH all recorded zero activity.

The four-day Ethereum outflow period from January 20 through January 23 totals approximately $611 million. Total net assets fell to $17.70 billion from $20.42 billion on January 16.

Cumulative total net inflow dropped to $12.30 billion from $12.91 billion. Total value traded reached $1.31 billion on January 23, down from $2.20 billion on January 21.