Bitcoin spot ETFs recorded $509.70 million in net outflows on January 30 and mark the fourth day of redemptions in five trading sessions.

Summary

- Bitcoin ETFs lost $509.7M on Jan 30, marking four redemptions in five sessions.

- BlackRock’s IBIT led selling as BTC ETF assets fell to $106.9B.

- Ethereum ETFs also bled $252.9M, extending a volatile outflow streak.

BlackRock’s IBIT led withdrawals with $528.30 million in outflows, while Fidelity’s FBTC attracted $7.30 million in inflows as one of just three funds posting positive flows.

The weekly total reached $1.49 billion in outflows for the period ending January 30, following the previous week’s $1.33 billion exodus.

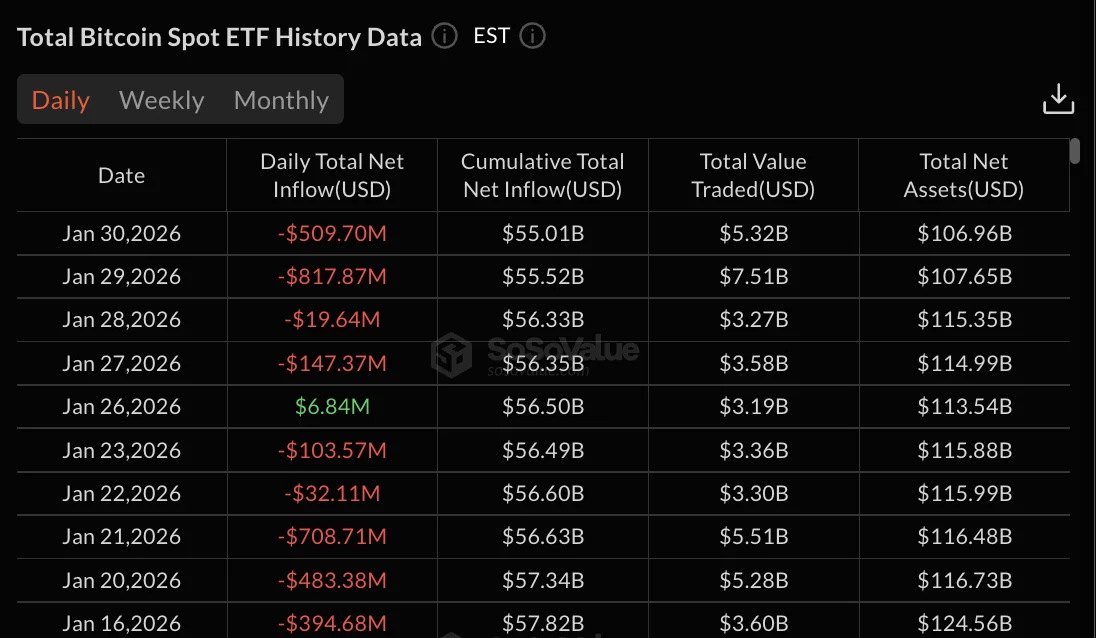

Bitcoin (BTC) struggled to maintain momentum near $83,000 as sustained Bitcoin ETFs selling pressure dragged total net assets to $106.96 billion from $115.88 billion on January 23.

Cumulative total net inflow fell to $55.01 billion from $56.49 billion over the same period.

January 29 posts largest single-day Bitcoin ETFs outflow

The outflow streak intensified January 29 with $817.87 million in redemptions, the largest single-day withdrawal since the selling wave began.

January 27 saw $147.37 million in outflows, while January 28 posted a more modest $19.64 million in withdrawals.

January 26 provided brief respite with $6.84 million in inflows before redemptions resumed.

Ark & 21Shares’ ARKB attracted $8.34 million in inflows on January 30, while VanEck’s HODL posted $2.96 million in positive flows.

Grayscale’s GBTC and mini BTC trust, along with Bitwise’s BITB, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all recorded zero flows.

Total value traded reached $5.32 billion on January 30, down from $7.51 billion the previous day.

The two-week outflow period from January 20 through January 30 has drained approximately $2.82 billion from Bitcoin ETFs.

BlackRock’s IBIT holds $61.96 billion in cumulative net inflows. Fidelity’s FBTC has accumulated $11.27 billion in total inflows.

Ethereum posts $252M in outflows as BlackRock leads

Ethereum spot ETFs recorded $252.87 million in net outflows on January 30, with BlackRock’s ETHA accounting for $157.16 million and Fidelity’s FETH posting $95.71 million in redemptions.

Total net assets for Ethereum products fell to $15.86 billion from $17.70 billion on January 23.

Cumulative total net inflow dropped to $11.97 billion from $12.30 billion. Total value traded reached $1.80 billion on January 30.

Ethereum ETFs have posted outflows in three of the past four trading days. January 29 saw $155.61 million in withdrawals, while January 27 recorded $63.53 million in redemptions.

January 28 provided a brief reversal with $28.10 million in inflows before selling resumed.