Today, we will talk about the difference between Bitcoin and Ethereum and how they will fit in an alternate finance infrastructure. In this article, we will compare Bitcoin versus Ehtereum.

History of Bitcoin and Ethereum

Cypherpunk’s moment led to the invention of Bitcoin. People were trying to create a digital monetary asset since the 90s. Until Satoshi (A sudo name used by the anonymous creator of Bitcoin) came up with system design in 2008, that didn’t require any third party.

Read: A Candid Explanation of Bitcoin

The design of Bitcoin not only an engineering breakthrough but also an economic achievement. For instance, it incentivizes miners to keep Bitcoin alive and distribute wealth to those who contribute back to Bitcoin.

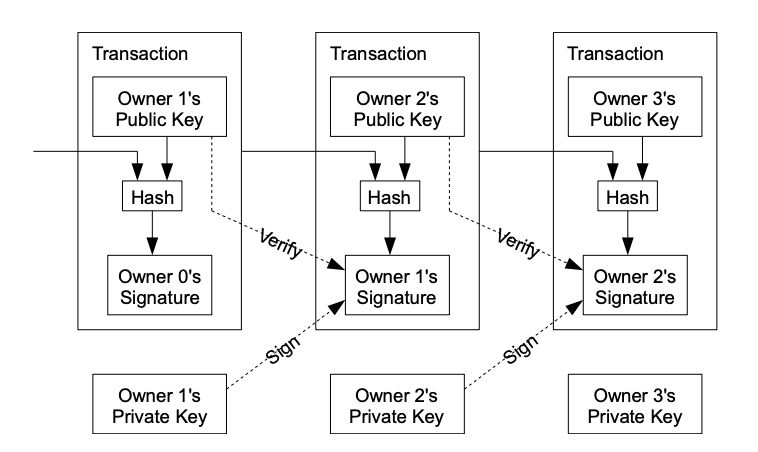

Bitcoin does not invent a new technology; instead, it creates a new design by using technologies that came into existence before it. For example, Bitcoin uses PGP, Adam back’s hashcash, and cryptography, which existed at least a decade before its invention.

Satoshi and some other contributors lead the Bitcoin development in the early years. But in 2011, Satoshi left the Bitcoin project. Since then, Bitcoin is leaderless and but its open-source development is lead by the Bitcoin-core team.

On July 20th, 2015, Ethereum’s genesis block was mined into existence, and the journey started. In 2014, Vitalik described Ethereum as a “Next-Generation Generalized Smart Contract and Decentralized Application Platform” in its white paper.

Ethereum brought smart contract technology to the Blockchain and created a platform for programming money.

Monetary Policy

The fundamental force behind the Bitcoin monetary policy is limited supply and fair distribution. It is hardcoded in the Bitcoin protocol that there will only ever be 21,000,000 Bitcoins. Besides, when it comes to distribution, Satoshi allowed everyone to mine Bitcoin from the start.

On the other hand, Ethereum team pre-mined 70% of supply, and Ethereum has inflation to incentivize miner to secure the network.

Read: Bitcoin Vs Gold – A better Store of Value

Account-Based Blockchain vs. UTXO based Blockchain

Bitcoin uses the UTXO model, where Ethereum is an Account-based blockchain. Let’s understand the difference.

In a UTXO based blockchain, there are no accounts or wallets, just unspent transaction outputs (UTXOs). Each UTXO has a quantity (bitcoin value) and criteria for spending it. A bitcoin transaction takes one or more UTXOs and produces one or more UTXOs.

Think UTXO as cash notes (Dollar bills). The advantage of the UTXO model is that it’s simple and stateless so that transactions can be processed in parallel.

Ethereum and other smart contracts blockchains use an account-based model. Here, Blockchain maintains accounts, and these accounts have balances associated with them. Accounts can either be controlled by a private key or a smart contract.

Account-based Blockchains enables stateful transactions and allows more flexible transactions.

Bitcoin script vs. Turing complete smart contracts

Do you know Bitcoin has its own scripting language? Bitcoin Script is a stack-based programming language used in by the Bitcoin protocol for transaction processing.

It is not Turing complete and does not support loops. Bitcoin script’s functionality is limited, and design is intentional to prevent things like Infinite loops. The script uses Opcodes to execute instructions, and there are limited opcodes.

On the other hand, Ethereum is an EVM machine which supports Turing complete language. For now, Solidity is the most popular language to develop Ethereum smart contracts. On Ethereum, executing every instruction cost Gas(Ether), so even you create an infinite loop using Solidity, you will be run out of Gas(Ether) when you execute it.

Store of value vs. Financial Infrastructure

Though Bitcoin was envisioned as a “Peer-to-peer electronic cash,” currently, the market view it as a “Store of value” because of limited block-space and high transaction fees. Though people are trying things like Lightning Network to solve high latency and transaction fee problem of the Bitcoin.

Read: What is Bitcoin and How Bitcoin Works?

On the other hand, Ethereum is true programmable money. It gives a platform to the developers where they can program money the first time in history. So, developers are building a lot of projects which look like bricks of an alternate financial infrastructure (Defi – Decentralized Finance).

A Beginner Guide to DeFi (Decentralized Finance)

Read: A Beginner Guide to DeFi (Decentralized Finance)

People are experimenting rapidly, and new financial innovations like Flash loans are coming into existence, which is not possible in the traditional financial markets.

Both Ethereum and Bitcoin have a protocol market fit in the digital age. Bitcoin a digital store of value; on the other hand, Ethereum a platform for decentralized financial infrastructure.

Community – Ethereum versus Bitcoin

Ethereum has the biggest developer community in comparison to any other blockchain. Meanwhile, Bitcoin has the starkest defender of its monetary policy. If you are a developer, it is easy to onboard on the Etheruem ecosystem. Besides, there is all sort of innovation happening in the Ethereum ecosystem; therefore, you can always find something which will interest you.

Read: Bitcoin for Beginners (Common Questions)

Wrapping Up

Bitcoin took a minimalistic approch in the composition of technologies to create a digital sovereign monetary asset and introduces the scarcity first time to the Internet.

On the other hand, Ethereum takes the Bitcoin beacon forward by introducing a platform to build an alternative financial infrastructure. Both are fantastic innovations and essential in this digital age.

Let us know what you think about our Ethereum versus Bitcoin analysis in the comment section.

If you want to learn more about the Crypto ecosystem, sign up for the weekly newsletter.