Ethereum holds steady above $3,300, as crypto traders gear up for President-elect Donald Trump’s inauguration. Derivatives traders are bullish on Ethereum, and open interest in Ether’s derivatives contracts crossed $30 billion as of Friday.

Ethereum’s large wallet investors continue accumulating the token despite its lacklustre price performance in 2024. The altcoin enjoys a high correlation with Bitcoin, and the recent market movers are conducive to gains in Ether.

Ethereum sees big bets from derivatives traders

Ethereum derivatives data on Coinglass shows a nearly 47% increase in options trade volume in the past 24 hours, as derivatives open interest hovers around $30 billion. Options volume crossed $1 billion in a 24-hour timeframe.

The long/short ratio, used to ascertain whether derivatives traders are bullish or bearish on a token, is greater than one on Binance and OKX. Derivatives traders are bullish on an increase in Ethereum price.

The chart below shows the increase in open interest in Ethereum since the latest US Presidential election. Open interest is below its peak of $31.99 billion, observed on January 7, 2025.

Ethereum on-chain analysis

Derivatives traders’ outlook is considered a measure of what traders can expect in spot markets. When combined with bullish on-chain metrics, derivatives traders’ outlook supports a thesis of gains in Ethereum price.

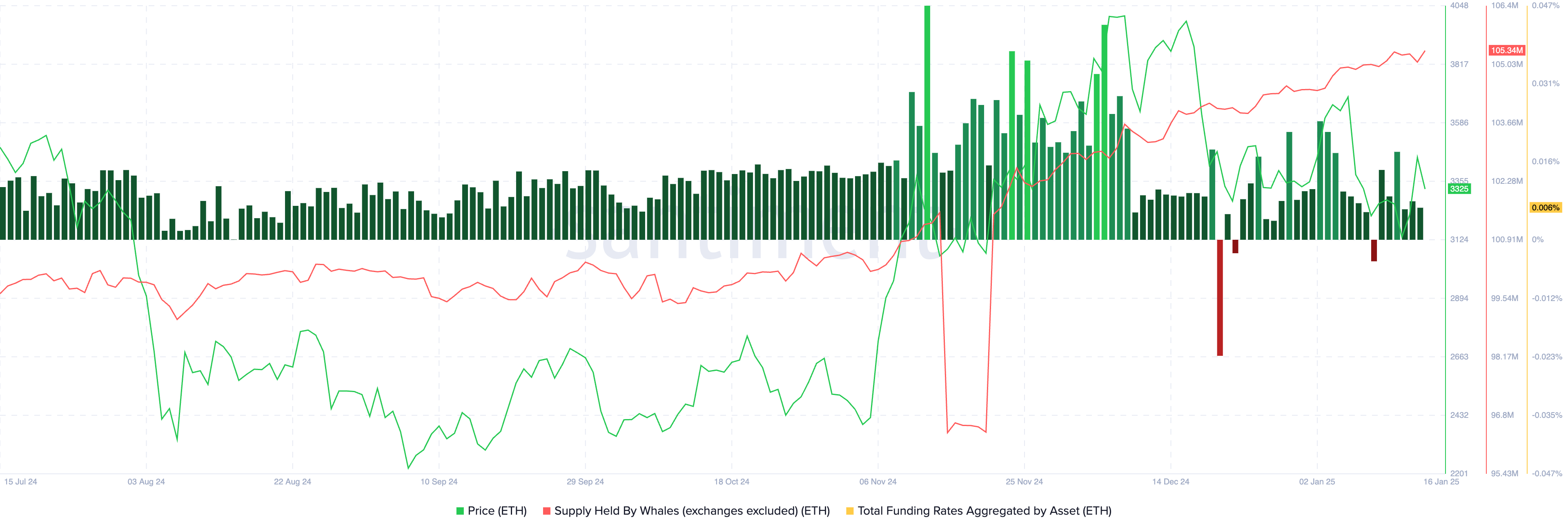

Santiment data shows that Ether token supply held by large wallet investors has climbed steadily, meaning even as ETH price suffered a decline, traders continued accumulating. This is a positive sign for Ethereum.

The total funding rate aggregated by Ethereum is mostly positive throughout January 2025. This represents optimism and hope for price gain among traders.

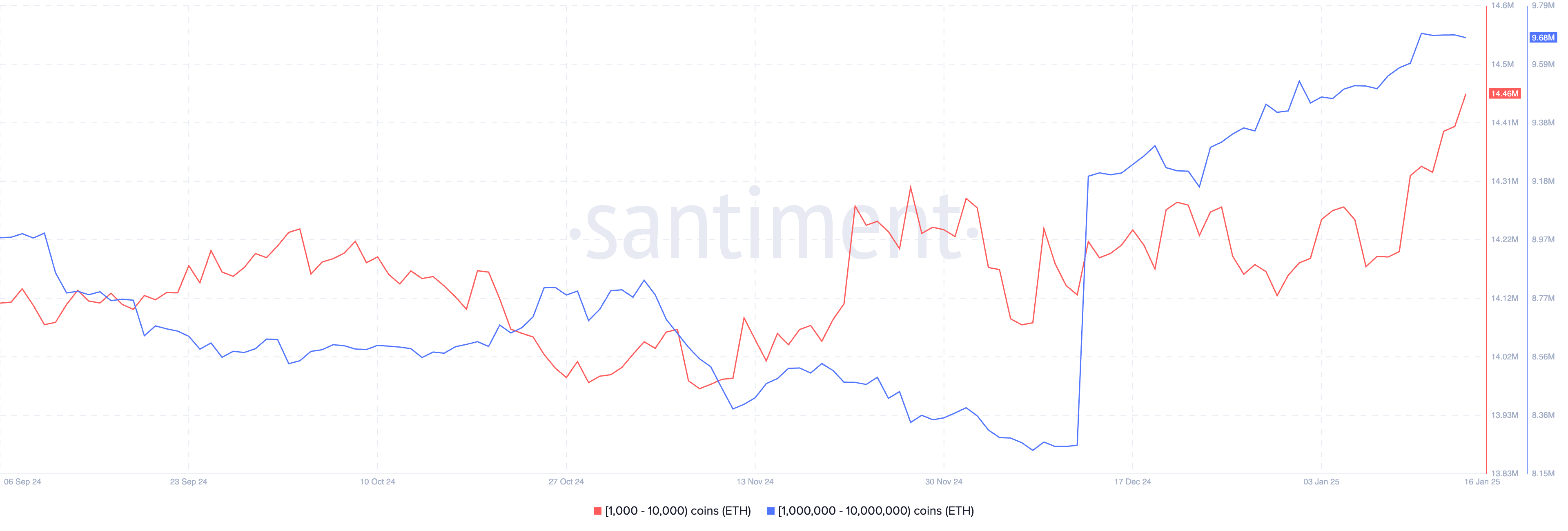

Ethereum held by traders with 1,000 to 10,000 ETH in their wallets increased in the past week. Similarly, holders with 1 million to 10 million Ether added to their ETH holdings between the last two weeks of 2024 and January 17, 2025.

Ethereum market movers

Farside Investors data shows that institutional capital inflow to Ether nearly doubled on Thursday. ETH Spot ETFs recorded $166.6 million in inflows on January 16, after 59.7 million the day before.

Typically, rising institutional interest is bullish for Ether.

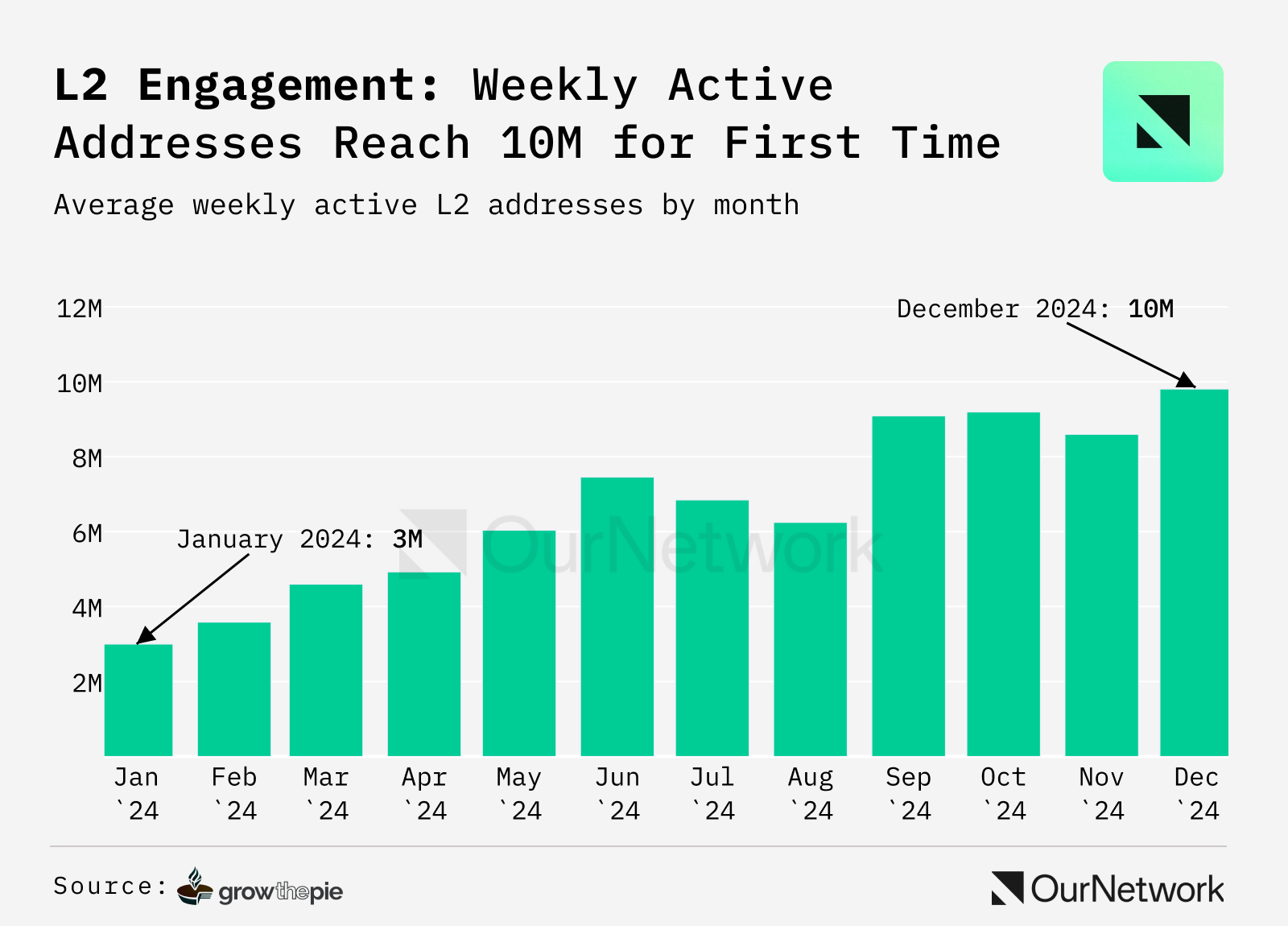

Another key market mover is the rising activity on the chain from Layer 2 protocols. Data from GrowThePie shows that Ethereum Layer 2 chains have experienced rapid growth in active addresses, increasing by over 300% in a year and surpassing 10 million weekly. Active wallets on multiple Layer 2s are relatively low, at less than 5%.

Rising Layer 2 adoption and utility contribute to revenue for the underlying chain, supporting a thesis of growth for Ether.

Technical analysis and ETH price forecast

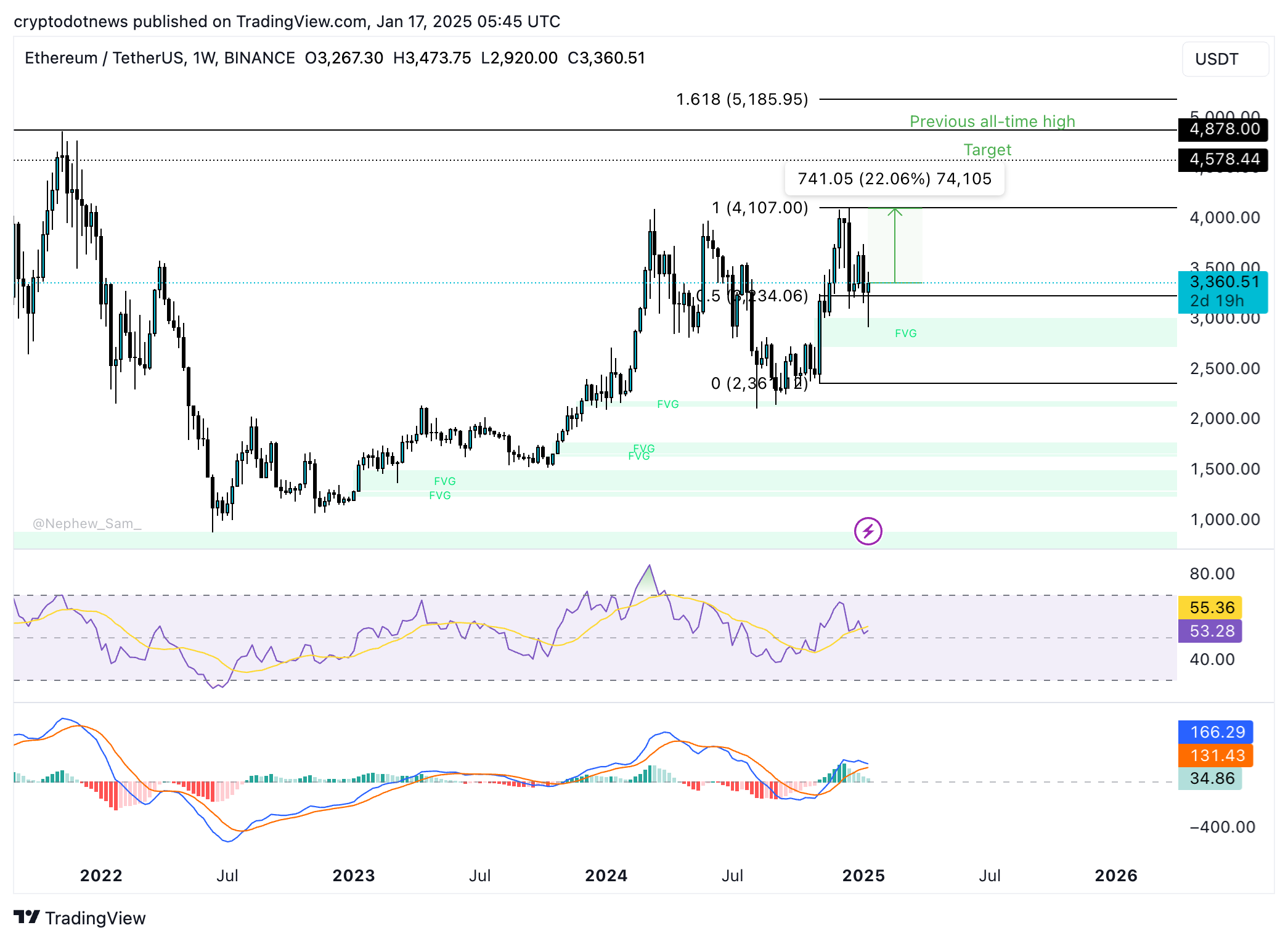

The ETH/USDT weekly price chart shows Ether hovering around the $3,360 level early on Friday. The altcoin is 22% below its 2024 peak of $4,107. Two technical indicators, the Relative strength index and the moving average convergence divergence, support a bullish thesis for Ethereum.

RSI is sloping upward and reads 53, MACD flashes consecutive green histogram bars, supporting a bullish thesis for Ethereum on the weekly timeframe.

If Ethereum ends its consolidation and breaks above the December 2024 peak, the altcoin could target the $4,578 level and rally towards its previous all-time high at $4,878, as seen in the ETH/USDT weekly chart below.

Vitalik Buterin’s take on Ethereum Layer 2 and the future of Ether

Buterin recently commented on Sony Block Solution Labs’ Soneium. Buterin said the project demonstrates how Ethereum Layer 2 is “great for businesses and users” in a tweet on X.

Buterin believes that the creation of a free market on the Layer 2 level makes it more accessible and useful for businesses and users, supporting the growth of the Ethereum ecosystem. The idea is to consider Layer 2 rollups as enterprises built in cities within the “Ethereum mainnet” state.

The controversy surrounding Soneium was the steps taken to safeguard intellectual property by placing restrictions on some contracts within the protocol. While it may seem as though meme coin traders have been cut off, users could continue transactions on the Ethereum mainnet with a delay of a few hours.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.