Bank of America states the U.S. economy is headed for instability as Donald Trump enters office, despite the strong employment and retail sales data being disseminated. This has brought renewed focus on the future of the crypto market. Will it thrive?

According to reports by Jinshi, Bank of America said on Jan. 20. that employment data, retail sales, and core inflation are holding strong, with core inflation at 3.2%. However, this number for inflation is above the mark, which means the Fed has no room to cut rates any further.

In December 2024, the Fed cut rates by 25 basis points, following a 25 basis point cut in November and a 50 basis point reduction in September. Fed Chair Jerome Powell stated in December meeting that no further rate cuts will occur unless economic data improves.

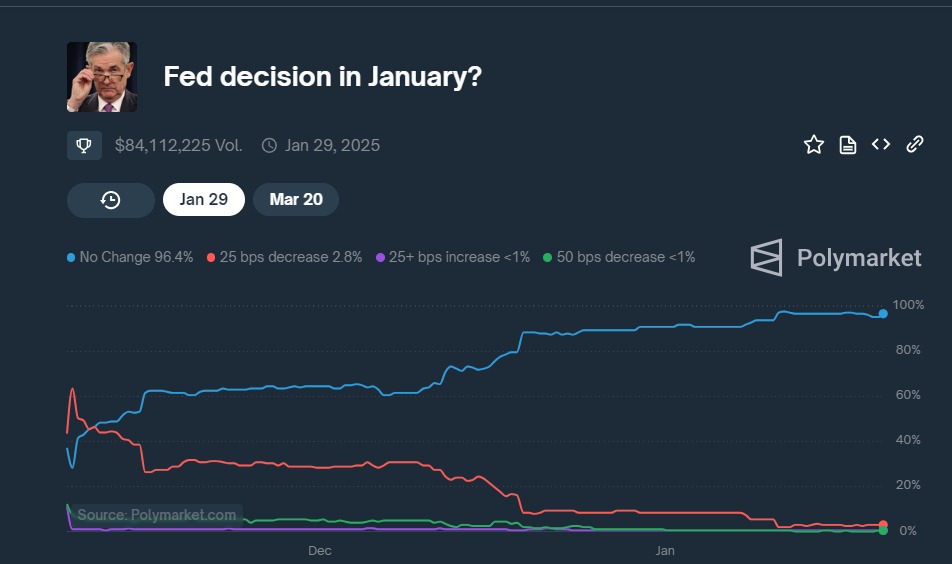

The sentiment against additional rate cuts is further reflected in Polymarket votes, where over 96% of bettors believe there will be no rate cut in January.

Now, Bank of America believes that with the oncoming presidency and, with it, the Trump 2.0 policies, there may be extreme security and fiscal uncertainty, and it could affect economic managers differently.

Trump’s Protectionist policies

Protectionist policies are government actions, i.e., tariffs or taxes on imports and trade restrictions, undertaken to protect local industries from foreign competitors.

During Donald Trump’s first term, these had quite an impact on the stock market. For instance, tariffs on Chinese goods and steel helped U.S. manufacturers with reduced competition. Still, they raised costs for companies that relied on imports, like carmakers and high-tech companies, as reported by the Tax Foundation in May 2024. Such continuously affected market ups and downs, especially during the trade war with China.

Reuters further reported that the same now could return via Trump’s reemergence with a 60% tariff on Chinese products, affecting the economy; this will raise prices and provide uncertainty to investors in the global market.

What is in for the crypto market?

The course of crypto’s future will largely depend on the interplay between Trump’s policies and Fed’s decisions. While protectionist policies generally exert their effects on traditional financial markets through inflation, supply chain disruptions, and investor sentiment, they will have a spillover effect on crypto markets.

Protectionist measures usually raise the costs of goods and services, which are typically passed on to consumers by companies.

For example, should inflation remain elevated, Bitcoin (BTC), often viewed as an inflation hedge, is likely to continue gaining traction, especially as the president has been heavily supportive on Bitcoin Reserve. Further, if the Fed does not cut rates to curb inflation, crypto might gain popularity as a store of value.

While many analysts are positive about a Bitcoin Reserve in the making, some within the crypto market are also voting against it. As of Jan. 20, Polymarket voters are only 57% confident that a Bitcoin Reserve would be created within the next 100 days.

Moreover, Trump’s crypto-friendly policies may also pave the way for institutional adoption of cryptocurrencies by supporting pro-crypto laws, potentially curbing litigation against crypto exchanges that the SEC had imposed under the Biden government.

All in all, while the protectionist policies could hike prices for some imports of tech goods, slowing the development of blockchain, Trump’s pro-crypto stance would offset some of this through its promotion of the growth of the sector.