Solana price is about to form a death cross pattern, pointing to more downside as its decentralized exchange volume, active users, and revenue crash.

Solana (SOL) token has dived to $159, its lowest level since Nov. 6, and 46% from its highest level in February.

This crash has happened as the ecosystem faces major challenges amid the meme coin price weakness. The total market cap of all SOL meme coins has moved from $25 billion in January to $9.8 billion. Most highly popular tokens like Dogwifhat, Official Trump, and Pudgy Penguins have shed billions in value.

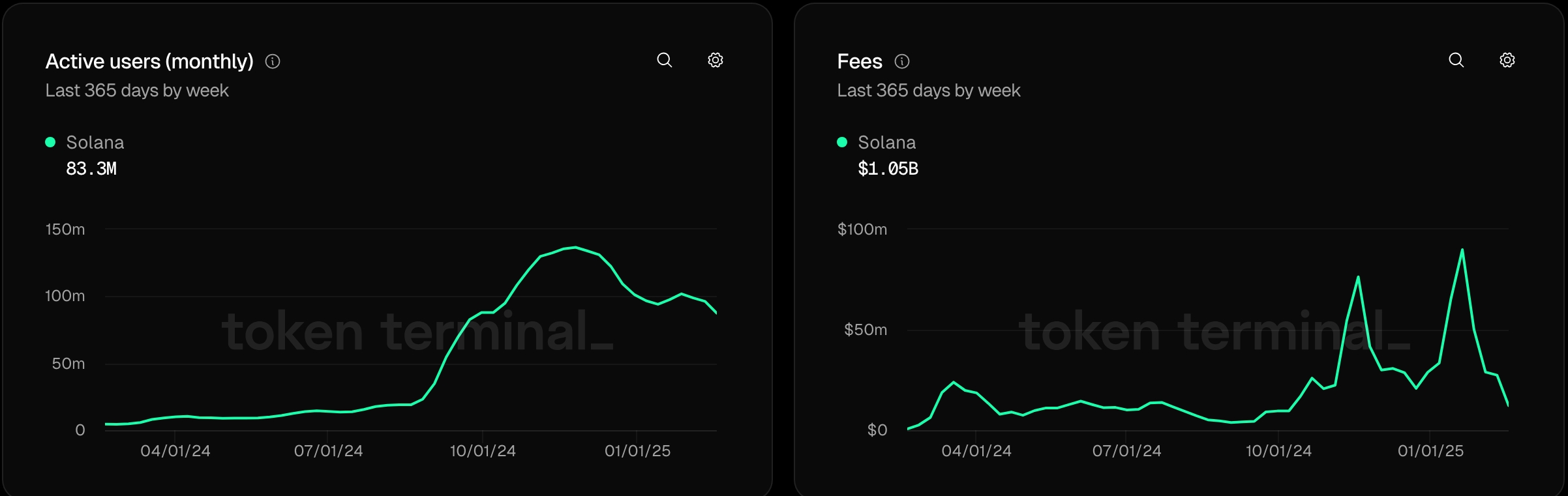

This trend has affected its internal metrics. TokenTerminal data shows that the number of active users has dropped to 87.3 million, its lowest level since Octover 7. It has dropped from the November high of 137 million.That is a sign that some Solana users have sold their tokens.

Solana’s revenue had also dropped below $1 million a day. It made $978,000 on February 14, down from this year’s peak of $44 million.

The decentralized exchange industry is also not doing well as the Solana meme coins plunge. Its DEX volume dropped by 36% in the last seven days to $16.7 billion, lower than Ethereum’s $18.3 billion and BSC’s $16.9 billion.

Solana price forecast

The daily chart shows that the SOL price has ben in a strong bearish trend after peaking at $295.28 in January 19. It formed a double-top-like chart pattern at $263, and whose neckline was at $169, its lowest swing on January 13. It has already dropped below that neckline, a sign that bears have prevailed.

Solana has also formed a death cross pattern, which happens when the 200-day and 50-day Weighted Moving Average cross each other. The Percentage Price Oscillator have moved downwards.

Therefore, the outlook for the SOL price is bearish, with the next point to watch being at $110, the lowest swing in August last year. This target is about 30% below the current level. A break above the $200 level will invalidate the bearish outlook.