- Cboe has submitted a 19b-4 filing to be allowed to list and trade options on spot Ethereum ETFs.

- The proposal follows high demand for Ethereum ETFs.

- NYSE American has made a similar proposal though it is yet to receive SEC approval.

The Cboe BZX Exchange has officially submitted a 19b-4 filing to the US Securities and Exchange Commission (SEC), seeking approval to list and trade options on spot Ethereum exchange-traded funds (ETFs).

This move signifies a pivotal step for Cboe towards expanding investor access to Ethereum, mirroring the growing demand within the cryptocurrency market.

Cboe seeks to expand its investment tools

Cboe’s proposal aims to broaden the spectrum of investment tools available to market participants. By allowing options trading on Ethereum ETFs, investors would gain an accessible means to engage with Ethereum’s price movements.

The 19b-4 filing includes funds such as those managed by Bitwise and Grayscale, notably the Grayscale Ethereum Trust and Grayscale Ethereum Mini Trust, which hold Ethereum as their primary asset.

The exchange posits that these options will serve not only as another avenue for investors to gain exposure to Ethereum but also as a crucial hedging instrument against the inherent volatility of the cryptocurrency market.

Notably, Cboe’s filling follows on the heels of a similar proposal by NYSE American, which has yet to receive SEC approval, with the regulator citing concerns over market manipulation, investor protection, and ensuring a fair trading environment.

The SEC’s hesitance is rooted in Section 6(b)(5) of the Securities Exchange Act of 1934, which emphasizes the protection of investors and the maintenance of fair and orderly markets.

Despite these challenges, Cboe’s proposal is framed as a competitive response to NYSE’s initiative, suggesting a potential market eagerness to see these financial products come to fruition.

Cboe’s approach in the filing underscores that Ethereum ETF options would be governed by the same stringent rules as other fund share options on its platform, including listing requirements, margin rules, and trading halts. This regulatory alignment aims to reassure the SEC of the proposal’s adherence to existing frameworks, similar to those applied to Bitcoin ETF options, which were approved under similar regulatory scrutiny.

The surge in investor interest in Ethereum ETFs

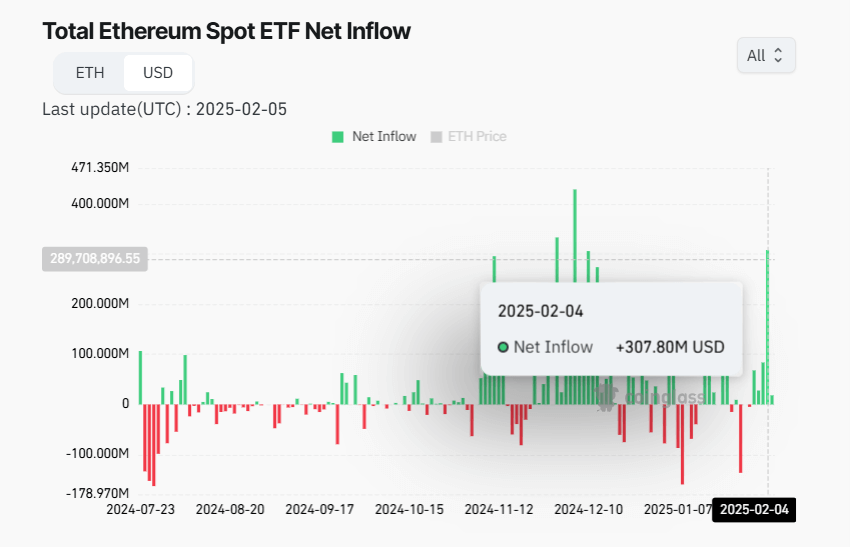

The timing of the Cboe filing coincides with a surge in investor interest in Ethereum ETFs. Recently, these funds have seen unprecedented trading volumes and net inflows.

For instance, on February 4, 2025, Ethereum ETFs recorded net inflows of $307.77 million, the highest single-day inflow of the year, demonstrating robust investor confidence.

This performance not only supports the rationale behind introducing options trading but also highlights the market’s readiness for such financial innovations.

The introduction of options on Ethereum ETFs could potentially stabilize Ethereum’s price by enhancing market liquidity.

Options provide sophisticated risk management tools for institutional investors, allowing them to hedge against price fluctuations. Retail traders might leverage these options for speculative gains.

This could lead to a more mature and stable market environment for Ethereum, fostering greater institutional adoption and contributing to the cryptocurrency’s mainstream financial integration.

Industry experts, like Nate Geraci from The ETF Store, have indicated that the approval process might follow a timeline similar to that of spot Bitcoin ETFs, which took about 8-9 months from launch to options trading approval.

If this precedent holds, we might see options on Ethereum ETFs becoming a reality in the near future, potentially as soon as next month, assuming regulatory hurdles are cleared.