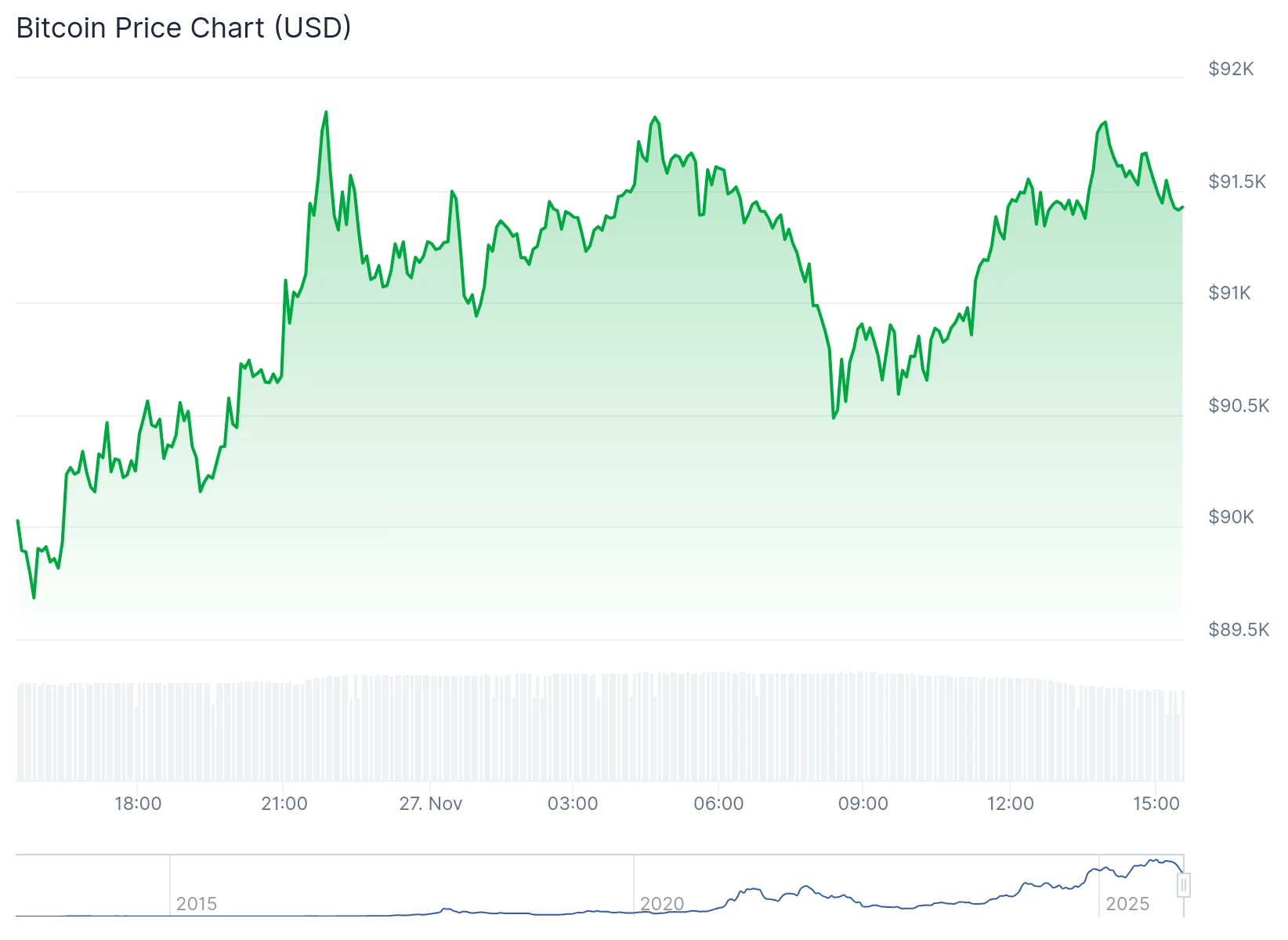

Bitcoin has recovered above a key resistance level following several days of selling pressure, though institutional selling from U.S.-based investors continues, according to market data.

Summary

- After days of selling pressure, Bitcoin has rebounded above a key resistance level.

- The Coinbase Premium Index remains negative, signaling that US institutional investors are selling more aggressively than retail traders.

- Ongoing outflows from Bitcoin spot ETFs have been identified as a key factor behind the sustained institutional selling.

The Coinbase Premium Index, which compares Bitcoin’s (BTC) price on Coinbase with Binance, remains in negative territory, according to analyst Darkfost. The metric indicates that institutional players and US-based investors are selling more aggressively than retail traders, as Coinbase serves primarily US institutions and professional investors while Binance is widely used by retail participants.

The ongoing sell-side pressure has been attributed in part to continuous spot ETF outflows.

Institutional selling pressure has eased since November 21, when the Coinbase Premium Index showed a sharp decline into negative territory, Darkfost reports. During that period, professional investors were offloading Bitcoin more aggressively than retail participants, contributing to the market’s decline toward recent lows.

While the Coinbase Premium Index remains negative, the depth of that negativity has softened in recent days. The metric has not yet turned positive, but the trend shows improvement, the analyst noted.

Temporary relief or a sustained recovery?

Bitcoin has bounced from the 200-day moving average on the three-day chart, a level that has historically served as major support during corrections. The cryptocurrency pushed back toward a nearby resistance area following the rebound.

Bitcoin currently trades below both the 50-day and 100-day moving averages, which have turned downward, indicating short-term trend weakness. Volume during the sell-off exceeded volume during the bounce, suggesting sellers were more aggressive than buyers.

The cryptocurrency experienced a sharp correction from its October all-time high. Market participants continue to monitor whether the recent price movement represents a temporary relief bounce or the beginning of a sustained recovery.