Rexas Finance surprised the market with a 325% achieve in a matter of hours. However as worth enters a corrective section, merchants at the moment are eyeing key ranges to find out what’s subsequent.

Rexas Finance (RXS) has delivered one of the eye-catching strikes throughout the market with an explosive 325% rally. The transfer was impulsive, aggressive, and fueled by momentum, however the true query is whether or not this was a blow-off top or merely a launchpad for increased costs. Whereas quantity has begun to say no, the market construction hasn’t but shifted bearish, suggesting this correction could also be a part of a broader bullish continuation.

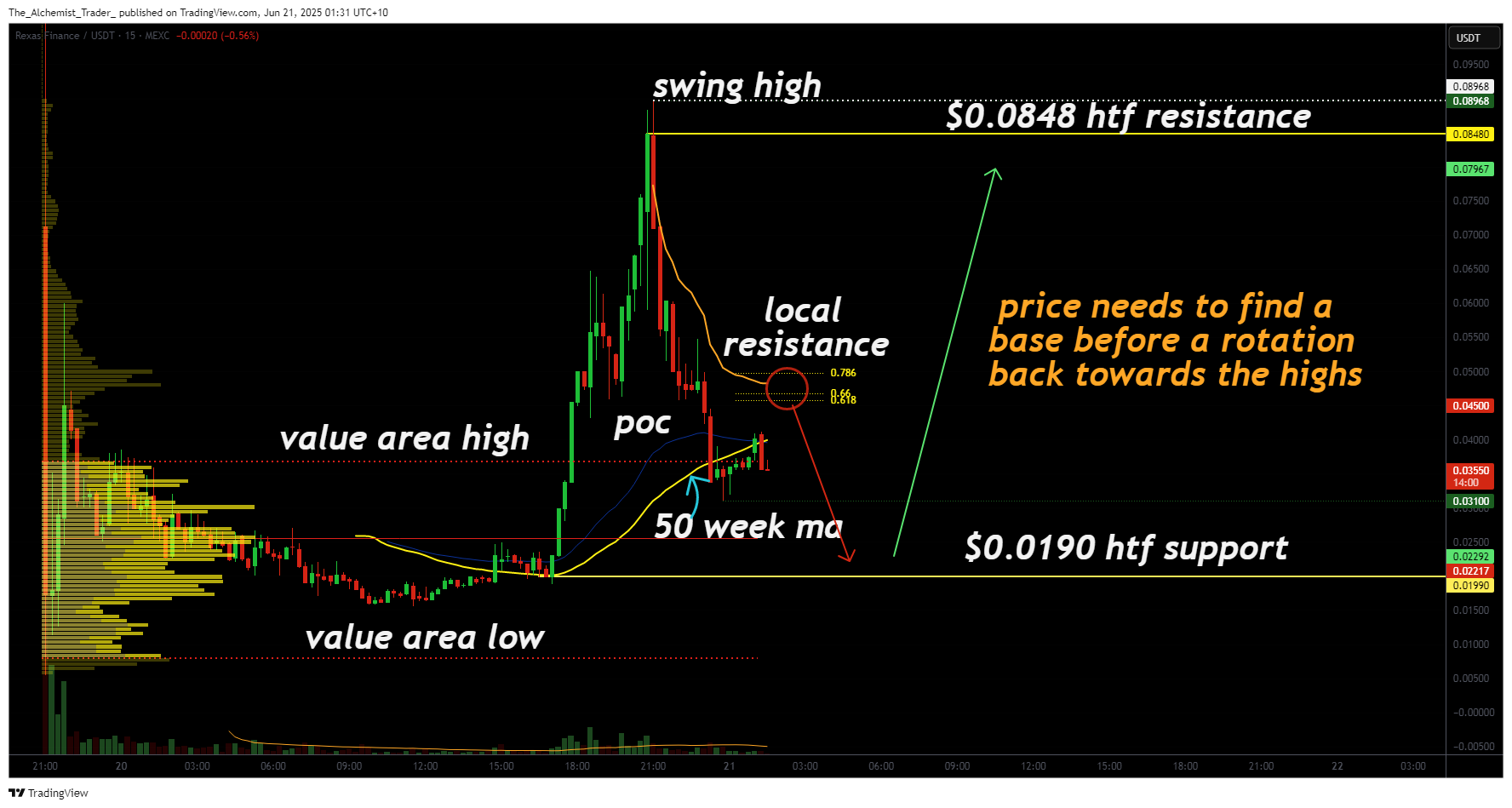

Key technical factors,

- Excessive Time Body Assist: $0.109; but to be retested

- Quantity Profile: Declining quantity post-rally hints at consolidation, not collapse

- Level of Management: Aligns with $0.109 assist, provides robust confluence

- Native Resistance: 0.618 Fibonacci retracement on the current drop

- Market Construction: No confirmed top or decrease low established but

Following the break above the worth space excessive, RXS surged right into a vertical rally that topped out over 325% from its prior base. Whereas such explosive worth motion usually alerts exhaustion, the correction that has adopted seems managed and in step with normal market conduct after massive impulsive strikes.

Importantly, the decline in quantity in the course of the correction section is typical in situations the place the market is trying to find a better low or new base, not essentially indicators of collapse. The $0.109 assist stage stands out as a vital zone. Not solely does this stage mark excessive time-frame assist, nevertheless it additionally aligns with the purpose of management from earlier quantity exercise, making it a powerful candidate for a bullish response if examined.

In the meantime, native resistance resides on the 0.618 Fibonacci retracement of the current pullback. If worth pushes up into this zone and fails to interrupt by, a rejection might ship RXS again towards the $0.109 stage, providing a possible base-building alternative earlier than any continuation.

Whereas worth motion stays unstable, the construction hasn’t damaged down. There’s no official decrease low, and no bearish market construction has been established. This means the market should still be in a wholesome corrective state quite than reversing altogether.

What to anticipate within the coming worth Motion

As RXS consolidates, preserve a detailed eye on whether or not it varieties a bottoming construction close to $0.109. A powerful response from that assist, particularly with an uptick in quantity, might set off one other leg increased. Till a decrease low is printed or key assist fails, the bullish narrative stays intact.