The crypto market turned crimson on Saturday and Sunday as geopolitical tensions spiked following President Donald Trump’s order to bomb Iran’s nuclear sites.

The U.S. joined Israel in launching strikes on Iran early Sunday, concentrating on three key nuclear sites in an operation geared toward crippling Iran’s nuclear enrichment capabilities.

Trump declared the mission successful, claiming the amenities had been “fully and completely obliterated.” Iran vowed to defend itself, in accordance to the New York Occasions.

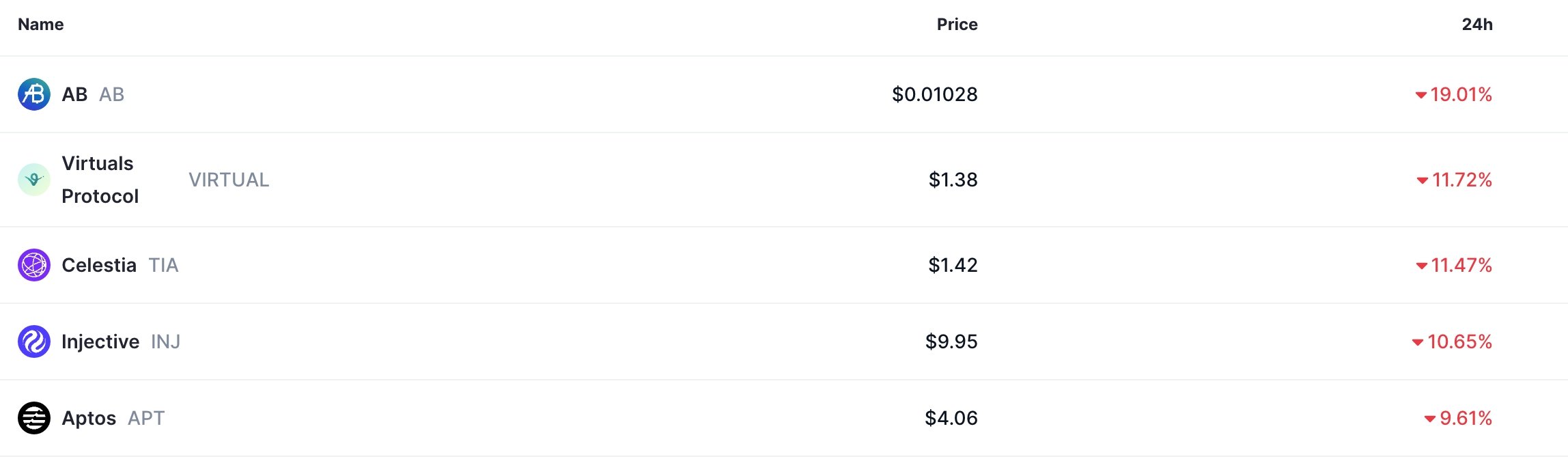

Finally verify on Sunday, Bitcoin (BTC) worth dropped under $103,000, whereas prime altcoins like Virtuals Protocol (VIRTUAL), Celestia (TIA), AB (AB), and Aptos (APT) plunged by over 9% within the final 24 hours.

The entire market capitalization of all cryptocurrencies tracked by CMC plunged by 1.65% within the final 24 hours to $3.15 trillion. Equally, CoinGlass information exhibits that the sell-off triggered a 38% surge in liquidations to over $682 million.

Crypto market crashed as geopolitical dangers rose

Bitcoin and most altcoins plunged after the U.S. launched a significant bomb in Iran concentrating on three nuclear sites. Trump’s purpose was to destroy Iran’s nuclear capabilities as its missile trade with Israel continues.

These belongings probably dropped for 2 most important causes. First, they dropped as traders embraced a risk-off sentiment following this assault. Traditionally, dangerous belongings like shares and cryptocurrencies retreat after a significant black swan occasion.

| CRYPTOCURRENCY | PRICE | 7-DAY +/- |

| Bitcoin (BTC) | $102,666 | -2.4% |

| Ethereum (ETH) | $2,273.95 | -9.7% |

| Solana (SOL) | $133.11 | -8.7% |

| XRP (XRP) | $2.03 | -6.1% |

| Dogecoin (DOGE) | $0.1557 | -10.8% |

| BNB (BNB) | $630 | -2.8% |

For instance, shares and crypto fell in April after Trump launched retaliatory tariffs. In addition they fell in March 2020 after the COVID pandemic began, and in February 2022 after Russia invaded Ukraine. In a observe to Bloomberg, Hanain Malik of Tellimer said:

“Brief-term, markets equivalent to crude oil, shares, and crypto will pivot on whether or not Iran retaliates and widens the battle in a means that impacts oil provide versus backing down and providing concessions on its nuclear program.”

Disaster in Iran could result in larger inflation

The opposite most important purpose the crypto market crashed is that the Center Jap disaster may result in larger crude oil and transport costs. Brent and West Texas Intermediate oil benchmarks have already jumped by over 32% from the year-to-date low, and analysts anticipate rising costs. Transport prices have additionally jumped.

The implication is that shopper inflation within the U.S. could preserve rising, which can forestall the Federal Reserve from slicing rates of interest.

In its assembly final week, the bank left interest rates unchanged between 4.25% and 4.50%. It hinted that it’s going to ship two cuts this yr and 4 in 2026 and 2027. Bitcoin and different altcoins do properly when the Fed is slicing rates of interest.