U.S. shares had been blended as geopolitical dangers briefly cooled, with the potential for fee cuts counterbalancing tensions with Iran.

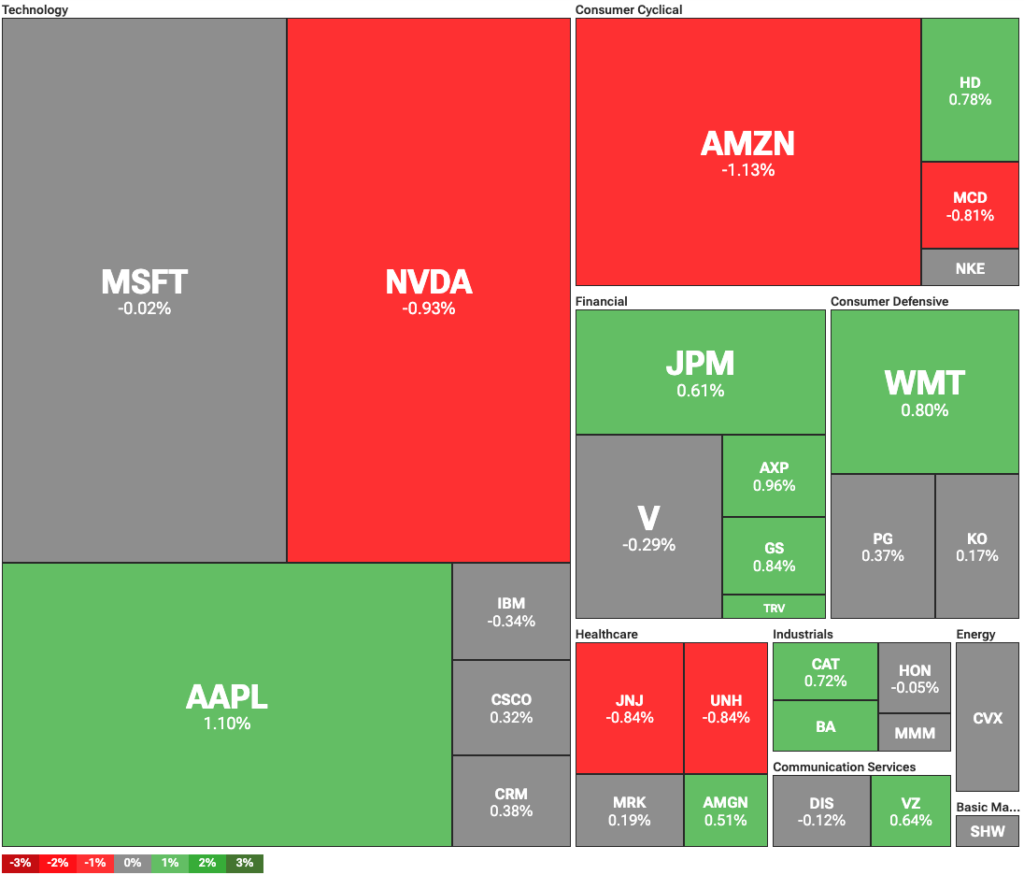

Main U.S. inventory indices traded blended amid a number of key developments. On Friday, June 20, the Dow Jones Industrial Common rose by 103 points, with Apple and monetary shares main the features. In the meantime, the S&P 500 was flat, slipping 0.03%, whereas the tech-focused Nasdaq fell 0.28%.

Merchants’ consideration was divided between a number of world and home occasions. Markets welcomed a short lived halt within the escalation between the U.S. and Iran. U.S. President Donald Trump said that he would resolve in two weeks whether or not to enter the Israel-Iran battle.

Whereas the assertion launched contemporary uncertainty, it additionally opened the door to potential diplomatic engagement. Nonetheless, Trump has thus far remained rigid on negotiations with Iran, demanding the whole dismantling of the nation’s nuclear program.

Fed governor suggests fee cuts in July

On the macroeconomic entrance, Federal Reserve Governor Christopher Waller suggested the Fed would possibly reduce rates of interest as early as July. He said that he doesn’t anticipate tariffs to considerably improve inflation, probably permitting for financial coverage easing. Nonetheless, the choice would require consensus from the total Federal Open Market Committee.

Trump, who appointed Waller throughout his first time period, has continued to stress the Fed to decrease charges. He has repeatedly criticized Fed Chair Jerome Powell, calling him “stupid” and the “worst”. Nonetheless, the Fed retains its independence, and Trump ruled out firing Powell.

In commerce information, the U.S. has informed semiconductor manufacturers that they’ll not be allowed to make use of American know-how of their Chinese language vegetation. The transfer is a part of an ongoing effort to curb China’s entry to superior semiconductors, which the U.S. considers a key strategic useful resource.