Shares inched increased at this time, regardless of issues over decrease retail spending and escalating retail costs.

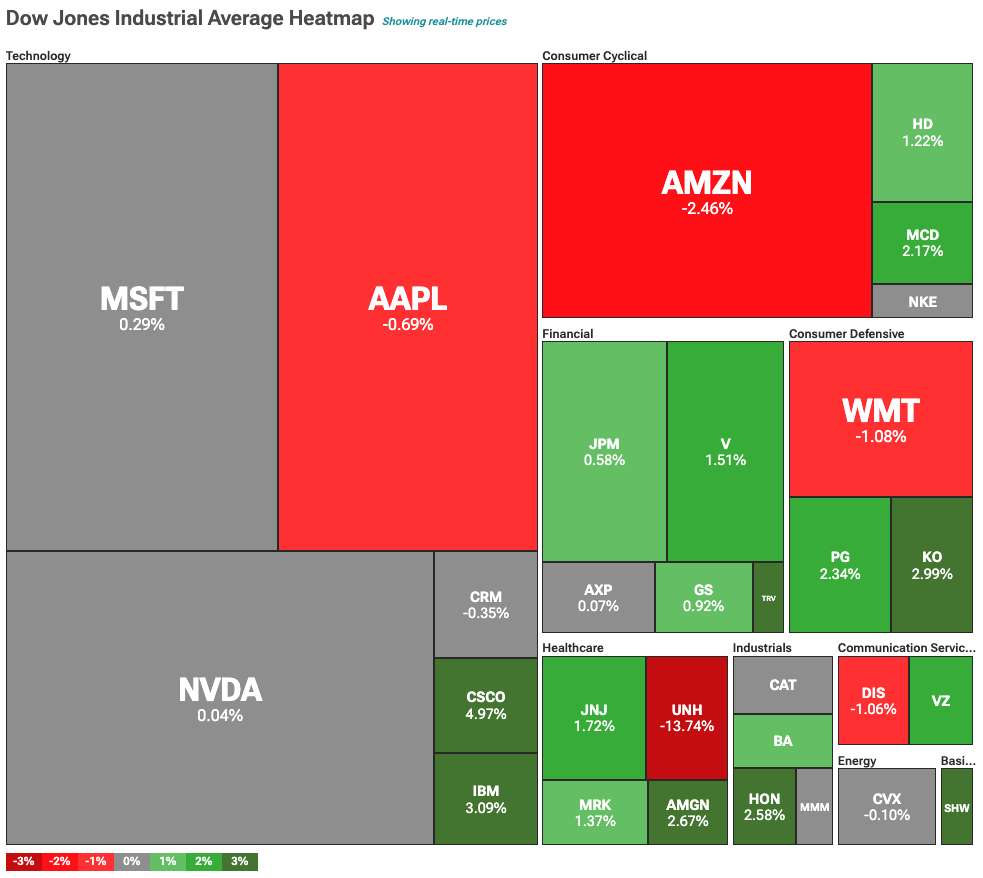

U.S. shares edged up on Thursday, Might 15, even amid unfavorable retail indicators. The Dow Jones was buying and selling at 42,191, up 140 points or 0.33%. The S&P 500 rose 18.75 points, or 0.32%, to five,911. In the meantime, the tech-focused Nasdaq was almost flat at 19,140 points, down simply 8 points or 0.04%.

Shares have been weighed by retail gross sales figures launched on the identical day. Notably, progress in retail gross sales slowed dramatically in April. Gross sales noticed gains of just 0.1% in comparison with March’s upwardly revised 1.7%. This was even supposing shoppers doubtless tried to spend forward, on fears of post-tariff price hikes.

Walmart warns about impending ‘double-digit’ price will increase

Including to inflation issues, Walmart CFO John David Rainey warned that the retail big could also be compelled to implement double-digit price will increase on some gadgets. Because of this, shares of Walmart—sometimes seen as a defensive inventory in inflationary environments, fell 1.05%.

Amongst different main corporations, UnitedHealthcare continued its decline, dropping 13.74% after stories revealed a possible criminal investigation in opposition to the corporate for potential Medicare fraud. Notably, only a day earlier than this revelation, the corporate’s CEO, Andrew Witty, abruptly stepped down from his place.

One of many new entrants on the S&P 500, Coinbase, confronted its personal upheaval. The inventory was down 6.58% after CEO Brian Armstrong revealed a $20 million ransom notice in opposition to the trade. Nonetheless, the likelier rationalization for the inventory drop in its inventory price is a current SEC investigation in opposition to it.

The SEC probe is about whether or not the trade reported correct numbers when it claimed it had greater than 100 million verified customers. The determine is critical, because the trade featured it in its 2021 IPO submitting, directed at potential traders.