U.S. stocks have trended higher as inflation data came in cooler than expected, boosting hopes that the Federal Reserve may cut interest rates.

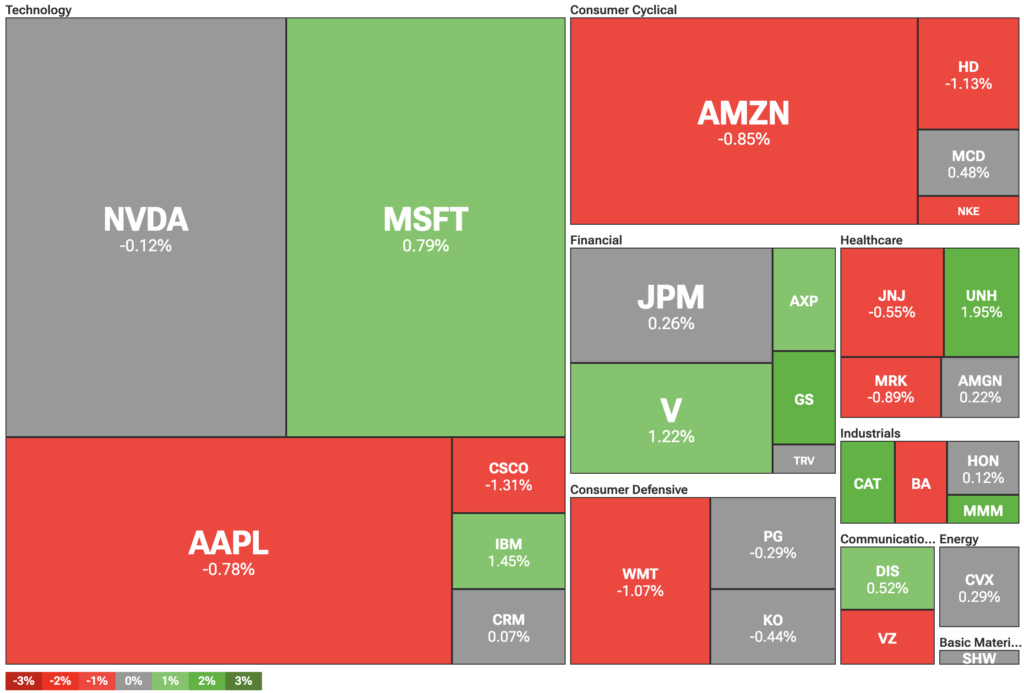

Traders are once again looking to Federal Reserve policy for direction. On Wednesday, June 11, the Dow Jones was up nearly 200 points, or 0.45%, while the S&P 500 rose 0.16%. At the same time, the tech-heavy Nasdaq was up 0.11%.

Markets are recovering on positive news from the trade front, even as monetary uncertainty remains in focus. Earlier on June 11, U.S. President Donald Trump stated that the country had reached a deal with China over rare earth minerals.

The issue had been a major stumbling block in negotiations, with China determined to maintain control over the strategic resource. At the same time, China demanded access to U.S.-made advanced microchips, which are crucial for artificial intelligence development.

While the trade news was positive, Federal Reserve policy remains a key concern for markets. Wednesday’s lower-than-expected inflation figures, just 2.4% year over year, suggest that there is room to cut interest rates to boost growth.

Trump pressures Fed to cut rates

Low inflation figures prompted Trump and the White House to increase pressure on Fed Chair Jerome Powell to lower interest rates. Most recently, Vice President JD Vance echoed Trump’s demands that the Fed should cut rates by at least one point.

Vance also accused the Fed of committing “monetary malpractice” by refusing to cut rates. For the administration, lower rates could boost stock prices and spur economic growth—potentially improving Trump’s approval ratings. However, the Fed remains concerned about inflation risks, particularly those tied to Trump’s tariffs.

Tesla shares were up 1.44% after CEO Elon Musk stated that he regretted the comments he made about Trump. Notably, the tech CEO claimed that Trump was in the Epstein files, suggesting that he might be connected to his crimes.