If you are a crypto enthusiast, there are higher chances of you coming across news of big crypto mining firms declaring bankruptcy while others are navigating through a liquidity scare.

Recently, Core Scientific declared bankruptcy under Chapter 11 while Greenidge is undergoing restructuring to avoid bankruptcy. Argo Blockchain is currently facing liquidity issues and has announced if they do not receive enough funding, it could go bankrupt soon.

From this, one can easily see that Bitcoin Miners have had a challenging past couple of months. Before dwelling on how profitable bitcoin mining is, it is crucial to know the present challenges Bitcoin Miners face.

Rising Energy Costs

Bitcoin mining is a complex computational and technological process of validating bitcoin transactions over the Bitcoin network. Energy in the form of electrical energy to mine Bitcoins. Increased energy prices will raise the costs for miners, which in turn could force them to sell their held BTC, thereby causing the price to fall lower.

In addition to this, heightened production can result in bitcoin miners demanding higher prices to cover their daily operational costs and, in some instances, even forcing them to close their operations entirely/sell their equipment.

Much to the dismay of miners, with inflation, electricity prices have soared 70% in parts of the world, leading some industry experts to estimate that mining a single bitcoin can now cost up to $25,000. According to the Digiconomist’s Bitcoin Energy Consumption Index estimates, one bitcoin transaction takes 1,449 kWh to complete, which is the equivalent of around 50 days of power for the average US house.

The worsening energy situation has also resulted in increased scrutiny of the mining sector since strong proponents of the 0 carbon emission campaign will have more backing for their criticism.

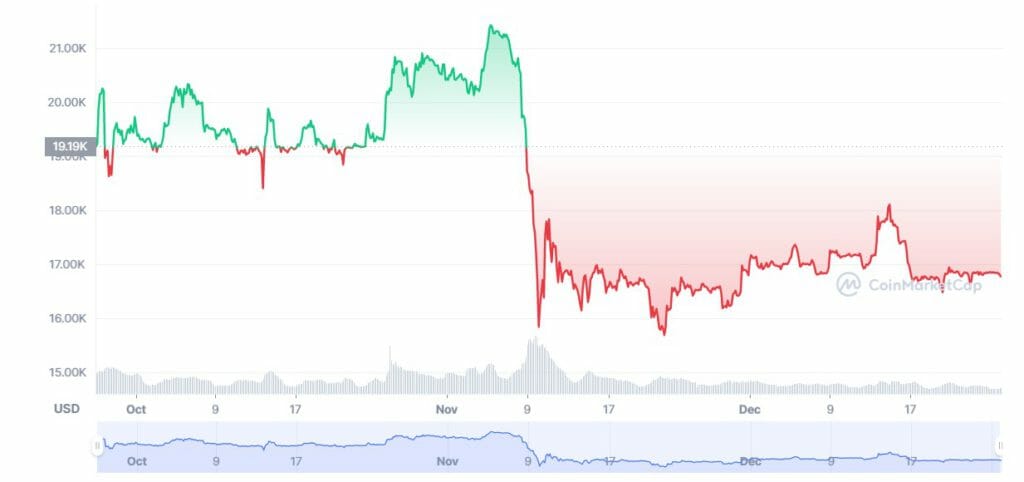

Plunging Bitcoin Prices

The price of BTC is one of the most evident factors impacting the bitcoin mining profitability as the value of bitcoin is directly proportional to profits yielded by miners.

Bitcoin’s (BTC) price again reached an all-time high in 2021, as values exceeded over 65,000 USD in November 2021. One year down the lane, in December 2022, the BTC price is wandering around the $16000 mark. The current low Bitcoin price is partly triggered by market letdown caused by FTX contagion.

Bear markets trigger even more attention to BTC prices from miners because they risk losing money if bitcoin drops below a certain price level.

On the bright side…

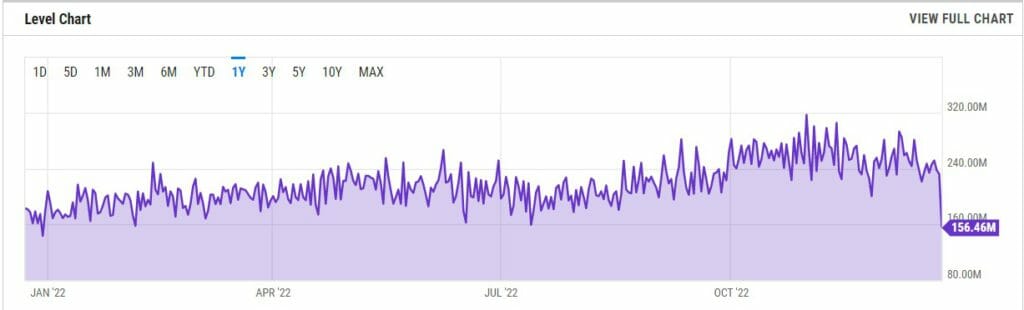

The Bitcoin hash rate is surging to new all-time highs, despite a heavy price drawdown. Any increase in the number of miners pushes BTC’s difficulty up, which then drives the hash rate up. Experts believe the increasing difficulty and hash rate are very positive for the security of the Bitcoin networks as it helps keep network more secure.

For example, CleanSpark grew its BTC mining hash rate from 1.9 EH/s at the start of 2022 to 6.0 EH/s or about 62,000 miners in December— an increase of 189%. Bit Digital and Riot Blockchain also increased their hash rate by 157% and 148%, respectively.

Source: Ycharts

Bitcoin Miner’s future prospects look promising since market participants expect BTC prices to go up soon, as more financial institutions are turning to digital cash for settlement purposes even amidst unfavorable market conditions.

Apart from this, the recovery from chip shortages in 2022 has also proven to be of great help to miners. As global markets recovered from chip shortages this year, the cost of the graphics processing units — a crucial component of mining rigs — came down to a lower price. Low GPU prices usually help miners offset their operational costs amid an ongoing bear market.

So, everything isn’t exactly bad in the bitcoin mining space as it may seem to be. So, How profitable is BTC mining amid current market conditions? The bottom line is that mining requires significant investment, and the results are unpredictable.

On top of the hardware investment, there’s also the cost of electricity to consider. Mining rigs use a lot of energy and also require fans to keep them from overheating. If you want to reap profits from Bitcoin mining, do adequate research, look out for market stats and BTC prices, invest in the right tools and join a bitcoin mining pool.