July 2025 was really hot if we speak about the crypto market and the crypto space in general: from the PUMP token ICO to Ethereum rush, from Bitcoin hitting a new all-time high to the passage of the landmark GENIUS Act. Portfolio management and trading automation platform Finestel shared a July 2025 market report that helps wrap one’s head around the month’s most seminal events and outline the most important trends for asset managers.

Summary

- Finestel points out that the lively boost of the first half of July shifted towards the accumulation and risk mitigation phase by the end of the month

- Institutional interest in crypto grew tremendously. Of all BTC accumulated since April, corporate treasuries bought over 40% in a single week of July

- August may be a pivotal month, moving Bitcoin to the $105,000 or $130,000 levels, depending on the Fed’s rate cuts and the performance of Solana’s Seeker Ships

July price movements

Experts from Finestel emphasize the contrasts of the July market performance, calling it “surge meets steadying” and reminding us that within a month, not only did Bitcoin’s price reach a record-breaking price, but it also pulled back by several thousand dollars.

Bitcoin

In the first week, amid tariff uncertainty, the Bitcoin price was fluctuating within a $105,000–$110,000 range. Finestel cites ETF inflows and on-chain buying spikes as the reason why the second week saw a 9% rise, when BTC price crossed the $120,000 mark. As the price passed the peak value, it settled at $117,000, prompting asset managers to reduce risks. The overall July gain amounted to 8%.

Ethereum

Ethereum’s figures were superior. It showcased a 17.03% monthly gain, reaching $3,800 and nearing $4,000. Finestel cites 29.4% staking and ecosystem rotations as the contributing factor.

Altcoins

The Altcoins market saw powerful volume spikes this July, with 43% and 48% ups in the second and third weeks, respectively. The 8% cooling took place by the fourth week when the trading volume dropped to $1.323 trillion, “with capital flowing into compliance tokens like XRP post-CLARITY Act.”

For the altcoin market, July turned out to be dynamic:

- Market cap rose 13.2%, reaching $3.85 trillion

- Daily volume increased 56%, hitting $161 billion

- At some point, Bitcoin’s dominance shrank to 60.6%

The Fear & Greed Index wasn’t moving away from the 70–75 range, “driving a 2% rotation into altcoins and more active trading.”

| Metric | Week 1 | Week 2 | Week 3 | Week 4 | Monthly Trend | Finestel Adjustment Notes |

| Bitcoin (USD) | ~$108k | $120k+ | $118k | $117k | +8% | Core up mid-month; trim 1% consolidation |

| Ethereum (USD) | ~$3k | $3.8k+ | ~$3.8k | $3.8k | +17.3% | Boost 3% on ETF flows |

| Cap (Trillion USD) | ~$3.4 | $3.771 | $3.905 | $3.919 | +13.2% | Rotate 2% alts on peaks |

| Daily Vol (Billion USD) | ~$98 | $139 | $161 | $161 | +56% | Bots scaled for spikes |

| BTC Dominance (%) | High | -0.69 | -3.75 | +0.18 | Net dip | Diversify 4% on falls |

Key on-chain signals

Within July, Bitcoin saw a shift from active trading to an accumulation phase. Finestel pointed out that BTC transactions peaked at 736,600 in the third week, but in the fourth week, this volume dropped by 50%, settling at 367,000 BTC, which vividly indicates a transition to a hold mode.

While July’s peak price was $123,000, the support line stood between $117,000 and $119,000. The volume grew by 665,000 BTC in the third week. Despite the new record price, profit-taking declined, falling from 300,000 BTC to only 150,000 BTC. Institutional demand grew, which is a strong sign of confidence. In July, institutions added 60,107 BTC.

In July, Bitcoin miners earned $1.66 billion, while the Ethereum staking revenue hit 29.4%, “with DeFi exposure correlating between 0.77–0.98.”

Below, you can see key on-chain signals outlined by Finestel:

- Bullish: Strong support at $117k suggests potential for $130k.

- Bearish: Distribution trends indicate possible dips below $115k, testing $105k–$108k.

- Neutral: Stable velocity favors shifts into altcoins as Bitcoin dominance declines.

Impact of Bitcoin ETFs and crypto treasury companies

Crypto ETF inflows, as well as the continuing trend of emerging and rivaling crypto treasury companies, had an impact across the crypto markets. According to Finetsel, of $12.8 billion attracted by Bitcoin ETFs in July, $6 billion flowed to Bitcoin and $5.43 billion flowed to Ethereum. BlackRock gained $84 billion, capturing 75% of new funds. The fourth week’s outflow was only $72 million.

Corporate crypto treasuries intensified their race in the fourth week of July, accumulating 60,107 BTC in just one week–over 40% of all bitcoins purchased by Bitcoin treasuries since April, marking increased demand for bitcoins from institutions. Strategy’s Q2 revenue from 628,791 BTC holdings amounted to $10 billion.

Regulation and macro factors

Finestel experts regard the CLARITY Act and GENIUS Act as catalysts for the crypto market’s activity in July. These acts helped to define the legal status of digital assets and “required stablecoin reserves,” halting the development of any central bank digital currencies.

Other bullish regulation shifts outlined by Finestel include Hong Kong’s striving for licensing crypto platforms and the SEC’s Project Crypto, a complex of tasks aimed at streamlining the development of the crypto sector in the U.S. “These changes are expected to increase compliant DeFi flows and liquidity, as seen with Ethereum’s growing stake at 29.4%,” concludes Finestel.

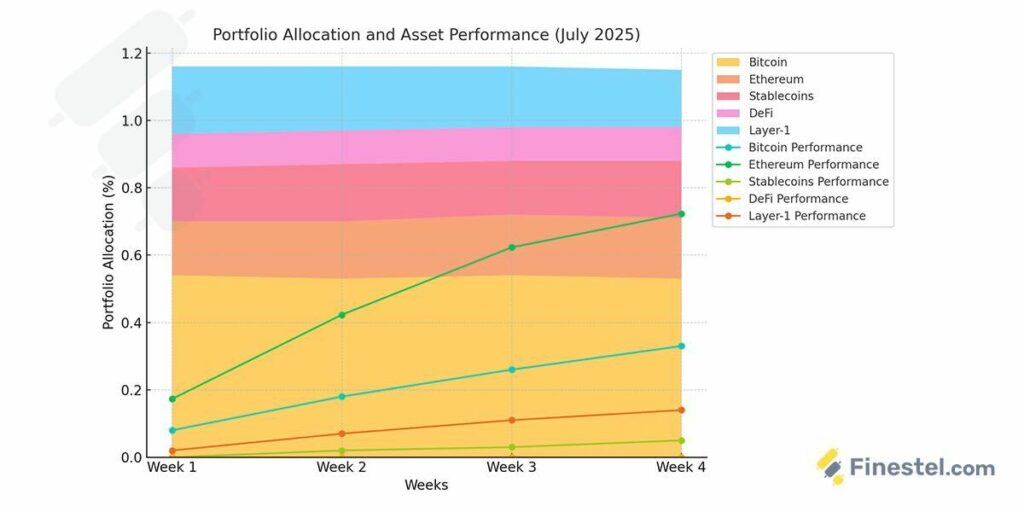

Portfolio allocations

Reacting to the changes in the market, the asset managers at Finestel made respective adjustments to the portfolios.

Below you can see a recap of the changes made by Finestel:

- BTC + ETH: 54% (trimmed by 1% due to volatility)

- Stablecoins: 16% (up 1% as a hedge)

- DeFi: 10% (up 1% for compliance-based yield)

- Layer-1: 20% (down 2% as rotations cooled)

What to expect next?

Finestel provided prospects for the August market performance, noting that the month can be pivotal with Bitcoin testing the $117,000 level. From this mark, it may slide down towards the $105,000–$108,000 range or hit $130,000 if positive factors turn out to be more influential.

The experts outlined key events to keep an eye on. They include the launch of Solana’s Seeker Ships, which may boost Layer-1 rotations and rate cuts by the Federal Reserve. The rate cuts may trigger liquidity inflow, driving the crypto market up.

The other prospects mentioned in the Finestel report are the possibility of Ethereum hitting the $4,000 mark and the potential for RWAs’ superb performance.

To improve flexibility, Finestel experts recommend portfolio managers to adjust BTC + ETH to 53%, to raise the share of stablecoins to 17%, and DeFi to 10%. In conclusion, they remind traders that automation tools may help to minimize risks and boost profits.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.