Data means that a good portion of Bitcoin could possibly be within the fingers of a restricted quantity of bigger wallets, probably pointing to rising focus.

As Bitcoin ((*10*)) adoption grows, possession continues to pay attention amongst bigger wallets, leaving retail traders with a shrinking share, per new data from Santiment.

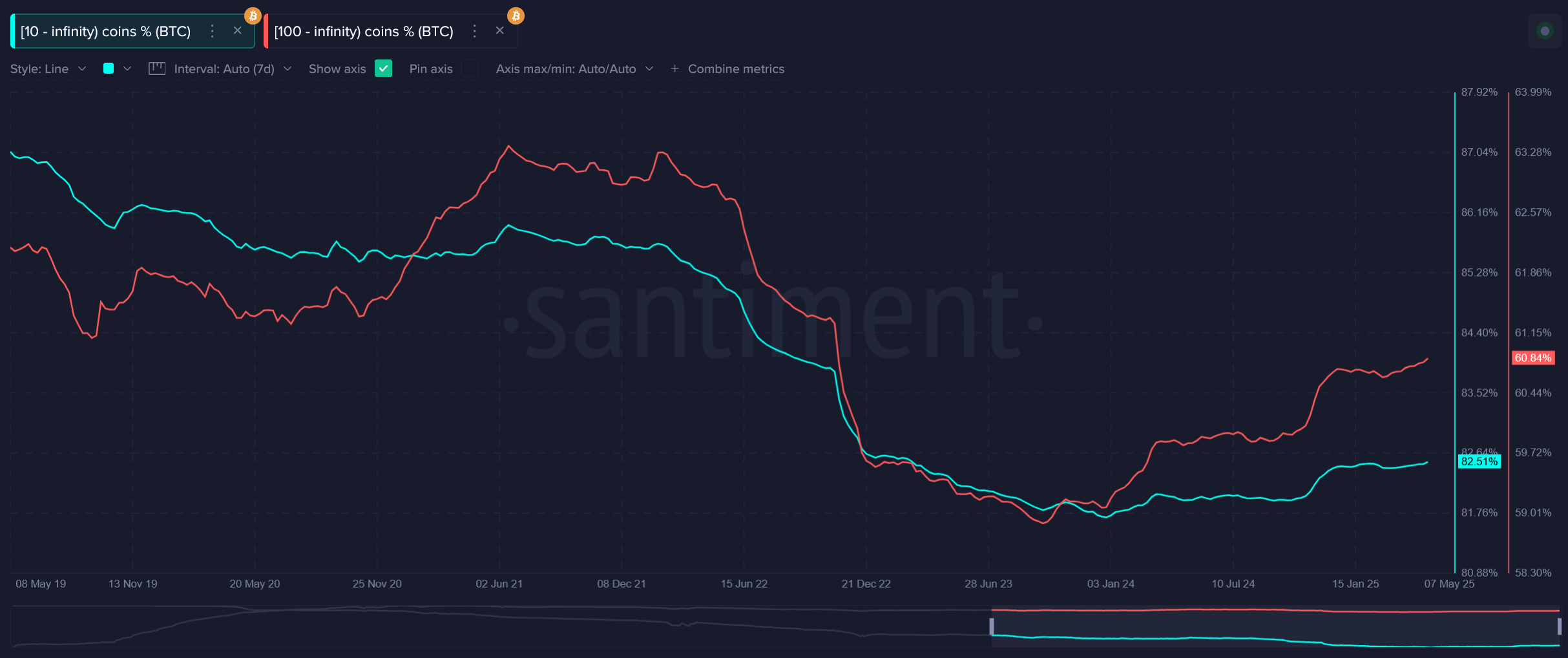

As of Might 13, wallets holding a minimum of 10 BTC — price about $1 million or extra — managed over 82% of the full mined Bitcoin provide. As Santiment analysts recommend, solely round 17.5% of Bitcoin is held by wallets “holding lower than $1 million in BTC.”

Wallets with 100 BTC or extra — at present valued at over $10 million — now maintain greater than 60% of the full provide. Santiment famous that the 10-100 BTC group may be broadly categorised as “primarily comprised of small institutional traders,” whereas wallets over 100 BTC are largely held by “institutionals and liquidity suppliers (with occasional exceptions of very giant retail wallets, of course).”

Some 3.47 million BTC stay in wallets holding fewer than 10 BTC, price an estimated $358 billion. Whether or not this smaller group will proceed to carry or promote might rely on future market sentiment, the analysts declare.

“Traditionally, main worth retraces are likely to instigate retail panic-selling, adopted by bigger wallets absorbing extra of the free cash that retail is now not comfy holding for the long term.”

Santiment

Crypto mining has additionally turn into much less accessible for people attributable to excessive prices and decrease rewards. On prime of that, many crypto miners have totally “embraced keen institutional traders, and sometimes take revenue shortly after their profitable mining classes are full,” the analysts added.

Santiment estimates that between 3 million and 4 million Bitcoin “could possibly be gone for good” attributable to misplaced non-public keys or inaccessible wallets, whereas round 1.14 million cash nonetheless stay to be mined till the 12 months 2140.