The worth of Solana plunged, underscoring deeper turmoil in its ecosystem, as weak spot in meme coin markets, DeFi exercise, and stablecoin transactions converge to stress the as soon as high-flying blockchain.

With SOL shedding over a quarter of its worth since Might and its broader community indicators sharply deteriorating, the sell-off highlights how speculative mania round meme tokens has bled into Solana’s fundamentals.

Nonetheless, technical indicators provide a glimmer of optimism—if consumers return quickly.

Solana dropped to $140, its lowest stage since April 22, erasing over $22 billion in worth because the market capitalization fell from $96 billion on Might 23 to $74 billion.

SOL’s retreat has coincided with the current dive of Solana meme cash, which have erased billions of worth. CoinGecko information exhibits that these meme cash have a market capitalization of $9.29 billion, down from over $30 billion in January to $15 billion in Might.

Previously seven days, most Solana meme cash have dived by double digits. Fartcoin (FARTCOIN) has dropped by 25% on this interval, whereas Popcat (POPCAT) and Gigachad (GIGA) have fallen by over 20%.

The continuing Solana meme coin retreat has negatively affected its ecosystem. For instance, DeFi Llama data show that the transaction quantity in its decentralized alternate protocols has dropped to $46 billion in June, down from $97 billion in Might and $262 billion in January.

In the meantime, Solana’s stablecoin community has deteriorated this month. Artemis data exhibits that the stablecoin transaction quantity has dropped by over 68% within the final 30 days to $179.5 billion. The variety of stablecoin transactions has plunged by 37%, whereas addresses have fallen by 20% to three.2 million.

SOL value evaluation as a bullish flag varieties

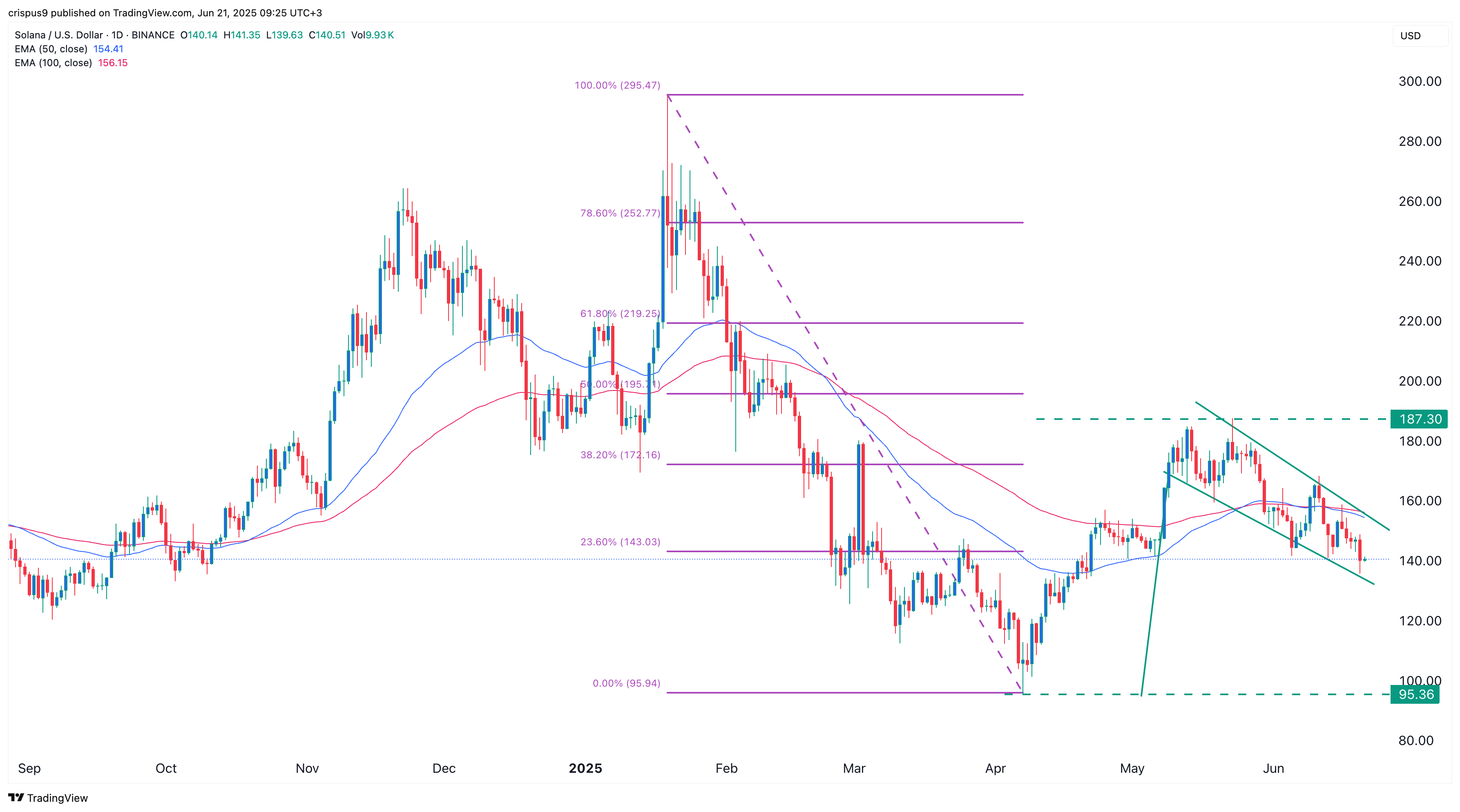

The day by day chart exhibits that Solana value has tumbled from $187 in Might to $140 as we speak, June 21. The 50-day and 100-day transferring averages have shaped a mini demise cross sample, usually resulting in extra draw back.

It has additionally dropped under the 23.6% Fibonacci Retracement, whereas the Relative Power Index and the MACD have pointed downwards, suggesting additional retreat.

On the constructive aspect, Solana has shaped a bullish flag sample, consisting of a vertical line and a descending channel. Due to this fact, there is hope that SOL value will bounce again within the subsequent few weeks. Such a rebound can be confirmed if it rises above the 100-day transferring common at $156, which coincides with the higher aspect of the flag channel.