Bitcoin (BTC) smashed past $118,800 last week, pulling the entire crypto market to a staggering $3.68 trillion valuation—its highest ever.

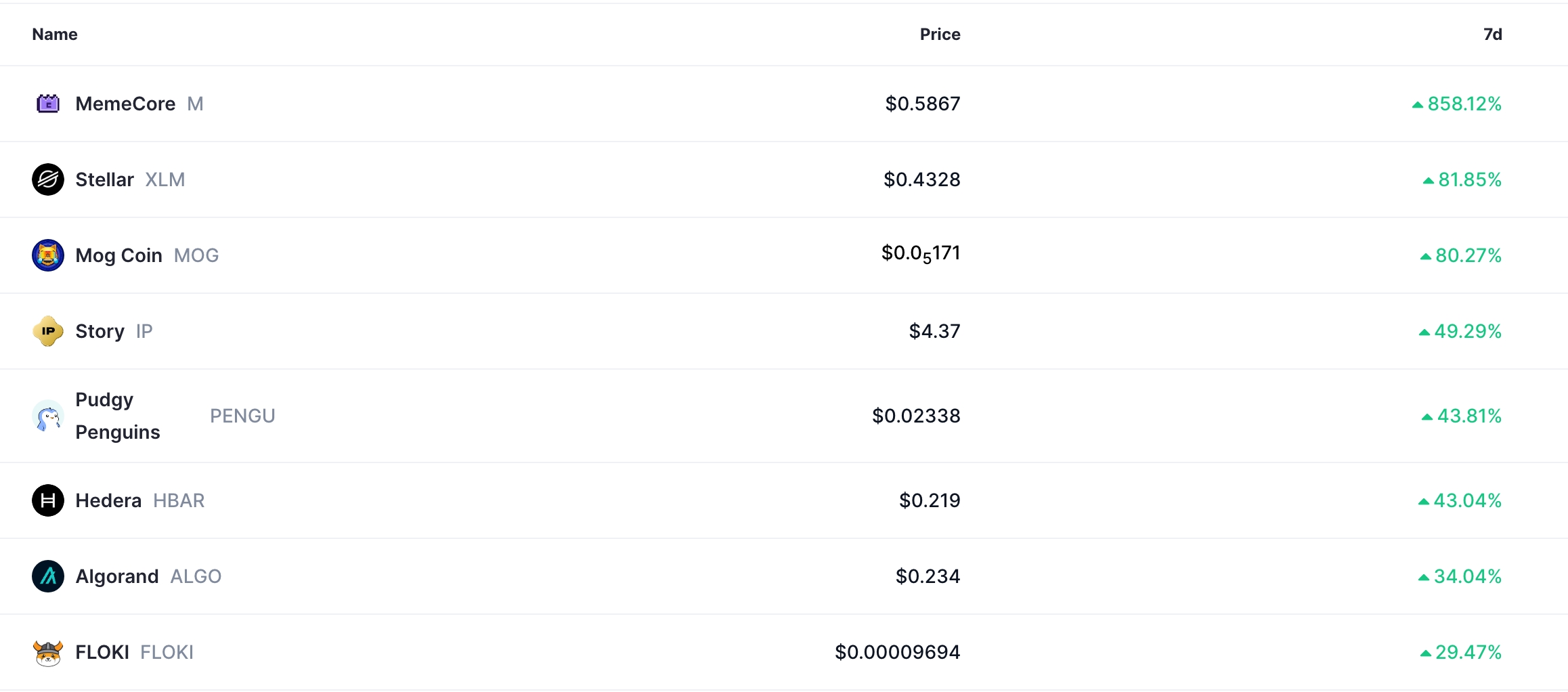

Meanwhile, altcoins like Stellar (XLM), Mog Coin (MOG), Story (IP), and Hedera (HBAR) rocketed to the top of the charts. But with inflation data looming, earnings season kicking off, and Congress preparing a legislative triple-header dubbed “Crypto Week,” this rally could either find fresh fuel—or hit turbulence.

This article explores the top four catalysts that may impact Bitcoin and altcoins this week.

One word: inflation

The main macro catalysts for Bitcoin and altcoins will be the upcoming US consumer inflation data on Wednesday. Economists expect the data to show that inflation rose in June as the impact of President Trump’s tariffs spread through the economy.

The median estimate is that core inflation rose slightly to 0.3% in June, the highest increase in months. This increase will result in an annual rise of 2.9%.

A higher inflation report, coupled with the recent strong U.S. nonfarm payrolls data, will lead to a more hawkish Federal Reserve. For one, it will lower the likelihood that the Fed will slash interest rates in July.

It will also lower the odds of a September cut, which will impact riskier assets, such as cryptocurrencies and stocks. Historically, these assets have performed well when the Federal Reserve is either cutting rates or signaling future rate cuts.

2 reasons why earnings matter this week

The next U.S. earnings season begins on Tuesday. Some of the most notable Wall Street companies that will publish their Q2 results are Goldman Sachs, BlackRock, JPMorgan, and Citigroup.

These results are key for the crypto market for two key reasons.

- If earnings are good and the stock market rallies, cryptocurrencies will likely generate gains

- Some of these companies may announce stablecoin or crypto treasury strategies.

3 pieces of legislation

Three bills are likely to appear in headlines as part of the so-called “Crypto Week”: CLARITY, GENIUS, and an anti-CBDC measure.

- The House Rules Committee is expected to post the GENIUS Act—a stablecoin policy bill—as early as this afternoon, setting it up for a floor vote later this week, according to Punchbowl News. The bill, which passed the Senate last month, will be closed to amendments, streamlining its path to becoming law. Despite this, House Republicans continue to push for changes to the legislation.

- The committee is also expected to post the CLARITY Act, which addresses the separation of crypto powers between the Securities and Exchange Commission and the Commodity Futures Trading Commission. The final version of CLARITY will reportedly contain proposed changes to the GENIUS Act.

- The Anti-CBDC Surveillance State Act, introduced by Rep. Tom Emmer on March 6, aims to block the Federal Reserve from issuing a central bank digital currency (CBDC). The bill prohibits the Fed from creating a CBDC directly or through intermediaries, bars its use for monetary policy, and reserves digital dollar issuance exclusively to Congress. The Blockchain Association, the Digital Chamber of Commerce, and several banking groups back it.

Clarity on the regulatory front usually bodes well for crypto prices.

Four Horsemen of the crypto ETF boom

One of the top catalysts for the crypto market last week was ETF inflows for Bitcoin, Ethereum, XRP and Solana exchange-traded funds.

Revisit crypto.news’ coverage: Various funds demonstrated robust demand from American investors. Spot Bitcoin ETFs had a net inflow of over $2.7 billion, while Ethereum funds had a net inflow of over $907 million.

The same trajectory happened with Teucrium’s XXRP and Rex-Osprey Staked SOL ETFs, which continued their momentum. Historical data shows that more inflows typically lead to higher Bitcoin and altcoin prices.