Coinbase stock worth had its greatest week since November final yr, whilst the corporate moved from one dangerous information to a different.

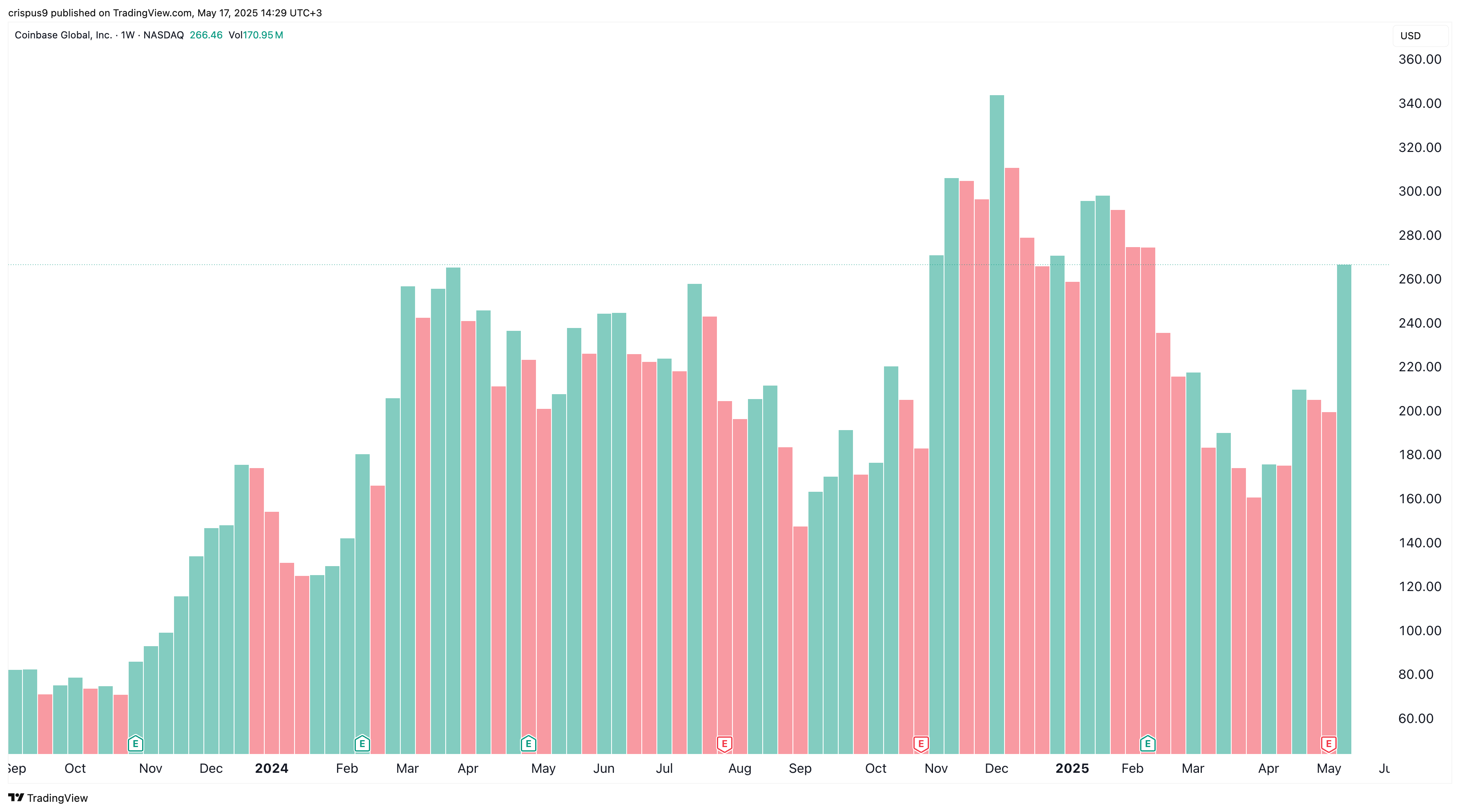

Coinbase shares ended the week at $266, their highest degree since February and 88% above their lowest degree this yr. This provides Coinbase a market cap of over $67.8 billion.

Coinbase skilled main headwinds

This rally occurred in a difficult week for the corporate and the crypto market. First, the current crypto market rally stalled, with Bitcoin (BTC) remaining stubbornly beneath $105,000 and lots of altcoins crashing by double digits from their month-to-month highs.

Second, Coinbase revealed a major hack which will price it over $400 million. The hackers collaborated with abroad workers, obtained delicate information, and demanded a $20 million ransom. Coinbase revealed that it’s going to not pay the ransom however as an alternative pays for suggestions resulting in the hacker’s arrests.

Third, it was revealed that Coinbase was underneath an SEC probe for misstating buyer information in its disclosures. The probe facilities on whether or not the corporate has over 100 million verified customers, because it claimed in filings. Coinbase has insisted that it stopped reporting that quantity two years in the past.

Why Coinbase stock worth soared

Coinbase stock worth rose despite these headwinds as a result of these occasions won’t have a significant impression on its enterprise. First, the continuing pullback within the crypto market will doubtless be momentary, with most analysts predicting more Bitcoin gains in the long run. Ark Make investments expects BTC to hit $2.4 million in 2030, whereas BlackRock has a $700,000 goal.

Second, traditionally, the impression of a hack to an organization’s efficiency is often restricted. For instance, Equifax’s stock worth has jumped since 2017 when it was hacked and information on 147 million prospects was stolen. Different firms which have thrived after their hacks have been Goal, Dwelling Depot, Sony, and Capital One.

Additionally, there’s a chance that Coinbase has insurance coverage protection that can assist with any associated funds.

Third, the continuing SEC probe began underneath the Biden administration, that means that the Paul Atkins-led company could determine to finish it. The SEC has already ended many earlier probes began by Gary Gensler.

Additional, this week’s occasions didn’t result in a downgrade by Wall Road analysts. Among the most bullish ones are from Benchmark, Rosenblatt, Oppenheimer, and Compass Level.

These analysts cite its sturdy market share within the U.S. and its growth to the derivatives market by way of the Deribit acquisition.

Most significantly, the Coinbase stock worth jumped forward of its addition to the S&P 500 Index on Monday. This addition implies that all funds that monitor the index will probably be pressured to purchase the stock.