Bitcoin Cash price continued its strong uptrend today, June 20, soaring to its highest point since Dec. 7.

Bitcoin Cash (BCH) has risen in the last five consecutive weeks to trade at $485, up 95% from its lowest level in April.

The rally occurred in a high-volume environment, with the daily figure jumping 75% to $757 million. Most of this volume was on Binance and HTX. Similarly, the rally came as futures open interest soared to $600 million, the highest level this year. Most of the futures open interest was from Binance, Bitget, Bybit, and OKX.

There was no major catalyst for the ongoing Bitcoin Cash price rally. A potential reason is that Bitcoin (BTC) was in the green on Friday, rising over 1% and reaching a high of $106,000. BCH is often seen as a proxy to Bitcoin because of their similarity.

Still, there is a risk to the ongoing BCH price surge. For one, the weighted funding rate turned negative, a sign that investors in the futures market anticipate the coin will trade lower than it does today.

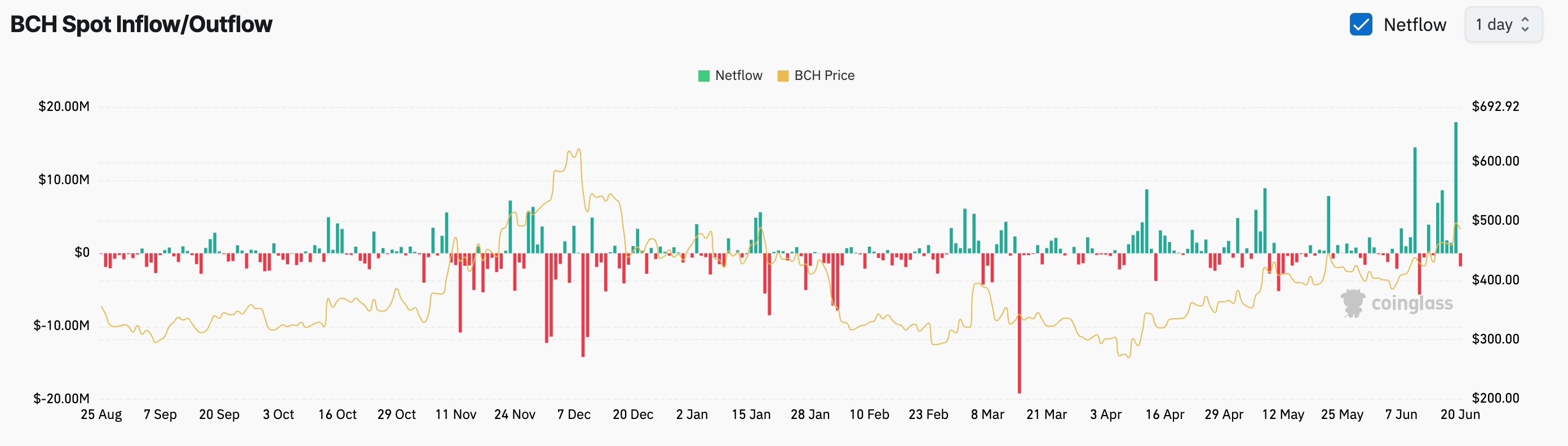

Another risk is that, as the chart below shows, exchange inflows surged to $18 million on Thursday, the highest level in over a year. Rising exchange inflows are a sign that investors are selling the coin.

Bitcoin Cash price technical analysis

Another reason for the ongoing BCH price rally is that it formed a giant double-bottom pattern at $284, its lowest swing in Aug. last year and April this year. This pattern’s neckline is at $640, its highest swing in Dec. last year and 35% above the current level.

BCH price has moved above the 50-day and 200-day Exponential Moving Averages, while the Average Directional Index has jumped to 23, a sign that it is gaining momentum.

Therefore, the coin will likely continue rising as bulls target the key resistance at $640. A move above that level will point to more gains as it validates the double-bottom pattern.