Riot Platforms sold 475 BTC in April, marking the largest single-month BTC liquidation in the company’s history.

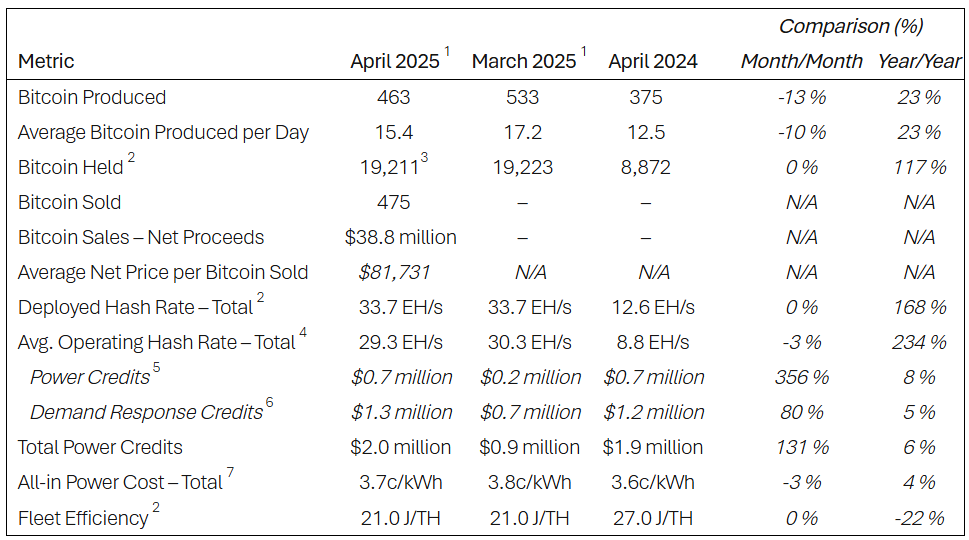

Riot Platforms, the second largest publicly traded Bitcoin mining firm by market cap, announced Monday that it had sold 475 BTC in April at an average price of $81,731, generating $38.8 million in net proceeds.

The sale, disclosed in Riot’s monthly production and operations update, marks the largest single-month Bitcoin (BTC) liquidation in the company’s history. Of the 475 BTC sold in April, 463 were newly mined in April, with the remaining 12 drawn from Riot’s reserves.

“During the month of April, we made the strategic decision to sell our monthly production of bitcoin to fund ongoing growth and operations. We continuously evaluate the best funding sources considering a multitude of factors and prioritizing a strong balance sheet. These sales reduce the need for equity fundraising, limiting the amount of dilution in our stock.” said Riot CEO Jason Les. ”

Despite the sale, Riot maintained a sizable Bitcoin reserve, holding 19,211 BTC as of April 30, including 1,900 restricted coins. That represents a 117% year-over-year increase in holdings.

This tactical move to sell BTC comes as Riot Platforms faced two consecutive months of challenging mining conditions, driven by successive network difficulty increases. The rising mining difficulty made it harder and more energy-intensive to mine BTC, contributing to a 13% drop in production from March.

While production dipped 13% from March, it still represented a 23% increase from the same month last year. The company maintains a deployed hash rate of 33.7 EH/s and a fleet efficiency of 21.0 joules per terahash, among the most competitive in Bitcoin mining industry.